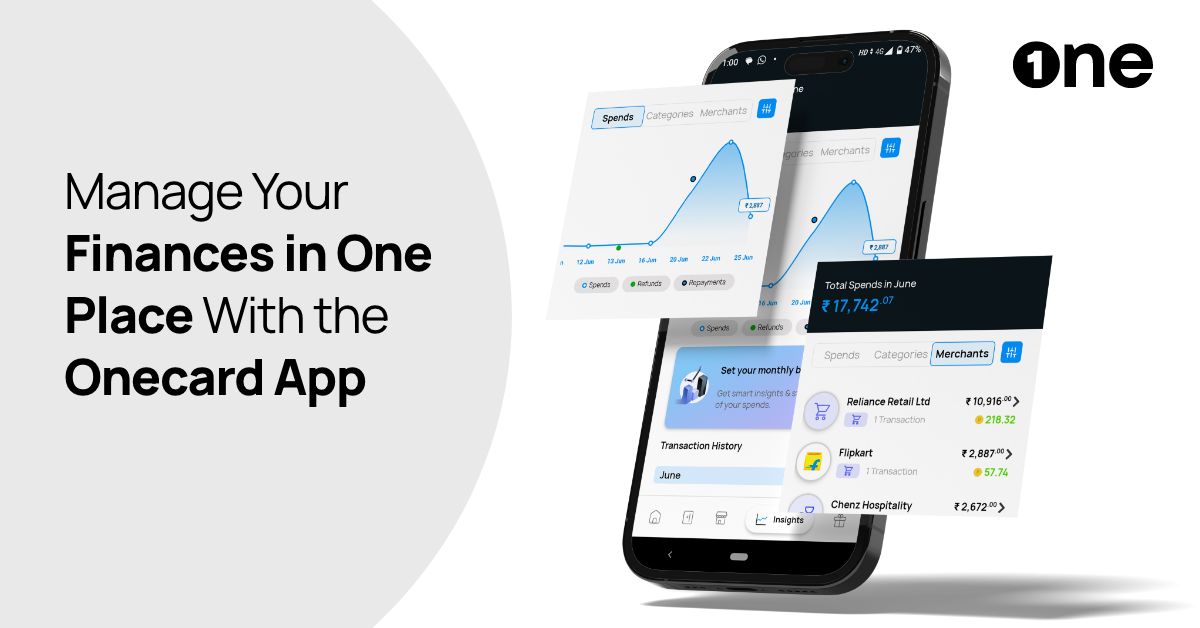

From Spending to Savings: Manage It All With OneCard App

By OneCard | July 29, 2024

In today’s digital age, having a user-friendly credit card app makes all the difference in managing your finances efficiently. The One Credit Card app stands out as a powerful tool, offering users a range of empowering features designed to simplify and streamline their financial journey.

Table of contents:

Accessing Exclusive Offers and Rewards

One of the standout features of the One Credit Card app is that it offers access to exclusive offers and rewards. By navigating through the app, you can discover personalised deals tailored to your spending habits and preferences.

1. Offers Around You

The ‘Offers Around You’ feature on the One Credit Card app allows you to access offers at stores near you. These include discounts on dining, shopping, and lifestyle experiences. Moreover, valueback reward points will be credited to your account within 10 days after the purchase.

2. OneTrips

With OneTrips, you can explore international holiday destinations within your budget. You also get a detailed expense planner and access to an in-built Forex calculator.

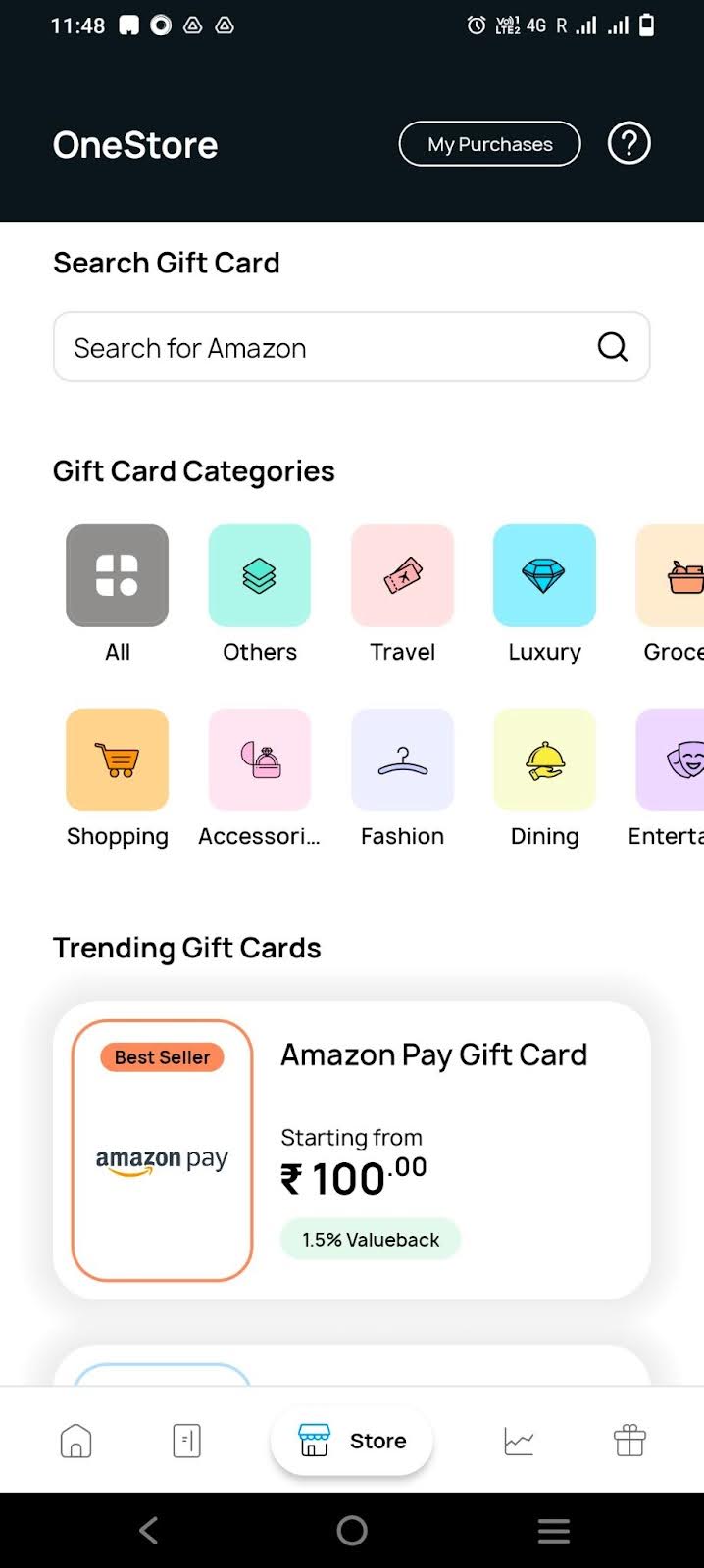

3. OneStore

This credit card app ensures you can maximise your spending while enjoying significant savings. In the OneStore section, you can buy gift cards across popular brands and categories. Further, you get valuebacks up to 10% of your purchase value.

4. Managing Expenses Efficiently

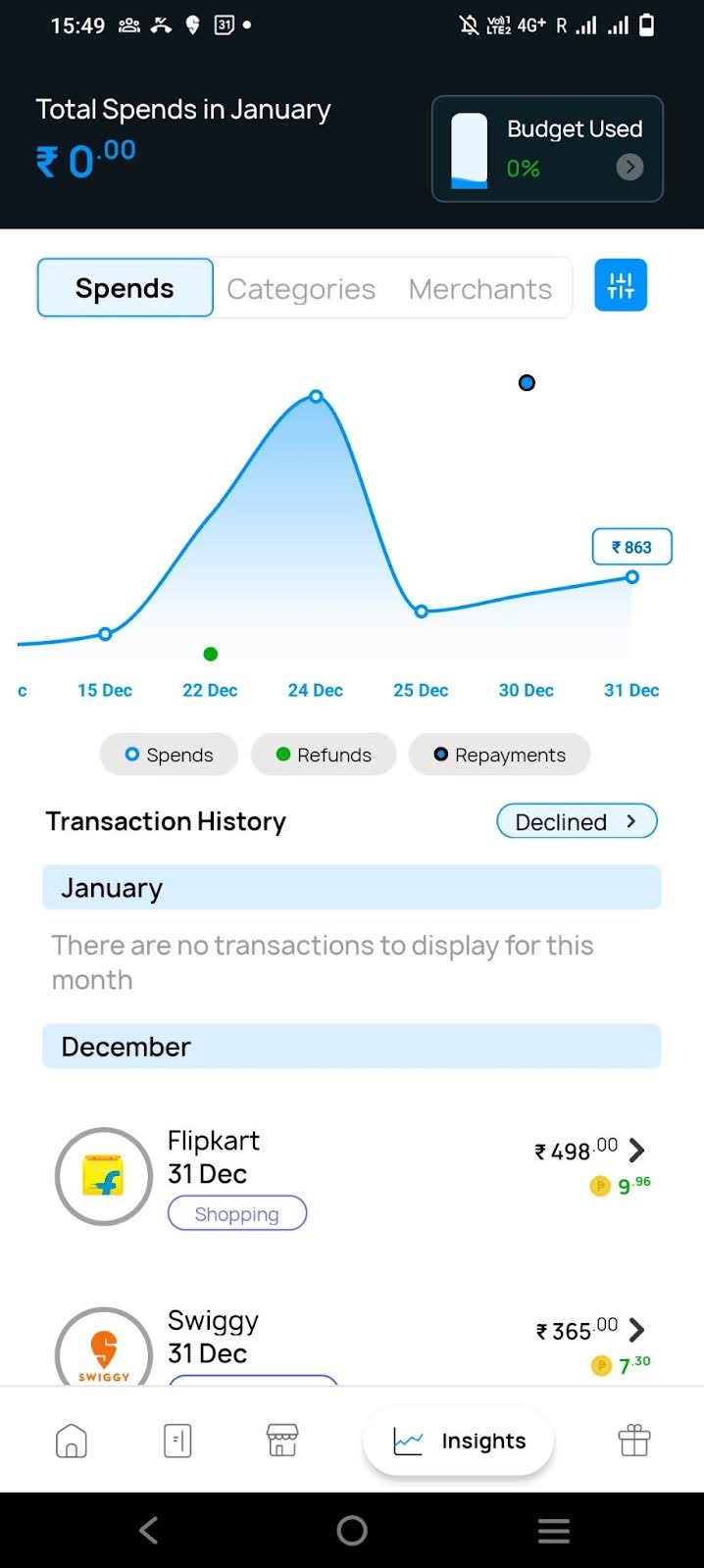

The One Credit Card app offers expense management tools that allow you to track spending in real-time, categorise expenses, and gain valuable insights into your financial habits.

5. Personalised Insights

One of the key highlights of this credit card app is its ability to provide personalised financial insights and recommendations based on your spending patterns:

- A visual analysis of your expenditure

- A category-wise and merchant-wise analysis of your purchases

6. Budgeting

You can set monthly budgets, even category-wise, to manage your spending habits. Spending analytics and goal tracking alert you when you exceed your budget.

7. My Family

The ‘My Family’ feature allows you to get add-on credit cards for your family members at no extra cost. You can get up to five additional cards. Whatever limit you set for the primary card is the default limit for all add-on cards as well. Although a single bill is generated, reward points remain separate.

8. Due Date Management

The One Credit Card app makes managing credit card due dates easy. Features such as automated debit, flexible due date adjustments, and scheduling payments ensure that you never miss a payment deadline. This proactive approach avoids late fees and maintains a positive credit history.

Streamlined Bill Payments

The One Credit Card app simplifies bill payments with its user-friendly interface and convenient payment options.

My EMIs

You can convert large expenses to EMI via the app. There are options for:

- Merchant EMI: The merchant/brand you shop from provides the EMI option. Additionally, it could be a no-cost EMI, depending on the brand partnership.

- Transaction to EMI: Transactions greater than ₹2,500 can be converted to EMI.

- Bill to EMI: Convert your bill into EMIs in case you are unable to pay the entire amount by the due date.

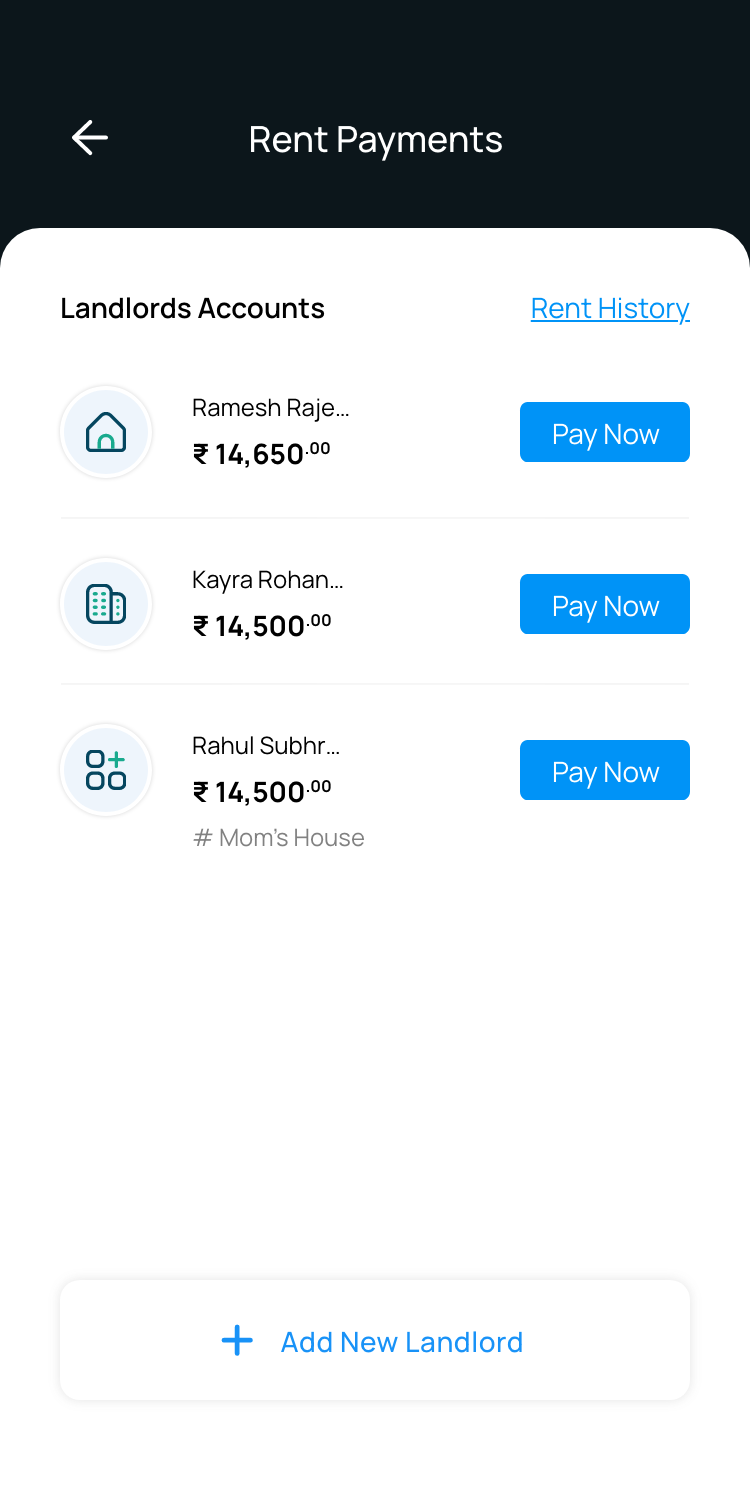

My Rent

In addition to bill payments, the One Credit Card app also simplifies rent payments for you. With features such as repeat rent payments, payment history tracking, and swipe to pay, you can set up automatic rent payments and monitor payment history with ease.

My Subscriptions

With the One Credit Card app, you can access all your subscriptions, such as Netflix, Spotify, etc., from one place. Simply visit the Subscription Hub to manage your subscriptions.

Enhanced Security Features

Security is paramount when it comes to managing finances, and the One Credit Card app takes security seriously. You can control all features of your credit card from the app itself. You get access to Domestic Controls, International Controls, and advanced Authentication and Limit Controls. With features such as tap-in app authentication, real-time transaction alerts, and fraud protection, the app ensures that your financial information remains safe and secure at all times.

ALSO READ: Tap In-App’ to Authenticate Your Online Transaction

The app offers you the convenience of contactless payments. You can make secure transactions with just a tap of your smartphone. With tap-to-pay technology integrated into the app, you can enjoy the benefits of contactless payments wherever you go. Additionally, the app also offers virtual card options, further enhancing the user experience.

In conclusion, the One Credit Card app offers you a comprehensive suite of features and functionalities designed to empower you to control your finances. From accessing exclusive offers and rewards to managing expenses efficiently and securely, the app provides you with the tools you need and enhances the overall credit card experience.

**Disclaimer: The information provided in this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Technologies Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader for making any decision based on the contents and information. Please consult your advisor before making any decision.

Sharing is caring 😉