The CSB OneCard Credit Card Most Important Terms and Conditions (In Hindi)

These Most Important Terms and Conditions apply to CSB OneCard Credit Card issued by CSB Bank Ltd (Bank) pursuant to a co-branded partnership with its co -branding partner Oneconsumer Services Private Limited (OneCard Credit Card). Activating your card from the OneCard app or clicking on ‘Submit’ or ‘I Agree’ or any similar tab/icon would mean acceptance of the below terms and conditions by the cardholder/cardmember/user (“You” or “you”).

The MITCs are in addition to and are to be read along with the detailed Terms and Conditions , and are subject to changes from time to time. The most recent version will always be available on the Bank’s website as well as on OneCard app.

Welcome to a world of convenience!

The OneCard Mobile App📱

You can control CSB OneCard Credit Card entirely from the powerful OneCard Mobile App, some of the actions being:

- Set your App PIN

- Activate your CSB OneCard Credit Card

- Make credit card bill payments

- Manage your virtual credit card

- Control your credit and cash withdrawal limits

- Enable online, domestic and international usage

- Set your CSB OneCard Credit Card PIN (For use at Point of Sale and ATMs)

- Raise disputes or service queries on any aspect of your CSB OneCard Credit Card

- Control your overlimit transactions

We have ensured that you can do the above transactions only in a secure environment after you authenticate yourself with your preferred authentication mechanism (Fingerprint/PIN). As a cardholder, you should be aware of the features and impact of these transactions as you would be responsible for your actions within the OneCard App.

Virtual Credit Card 💳📲

In addition to the physical CSB OneCard Credit Card, you will receive as part of the on-boarding process, a virtual rendition of the CSB OneCard Credit Card which will be available on the OneCard App.

This virtual card is also a MasterCard powered credit card so that you can use it for any online or mobile application-based transactions or purchases. The security parameters are set as per industry standards.

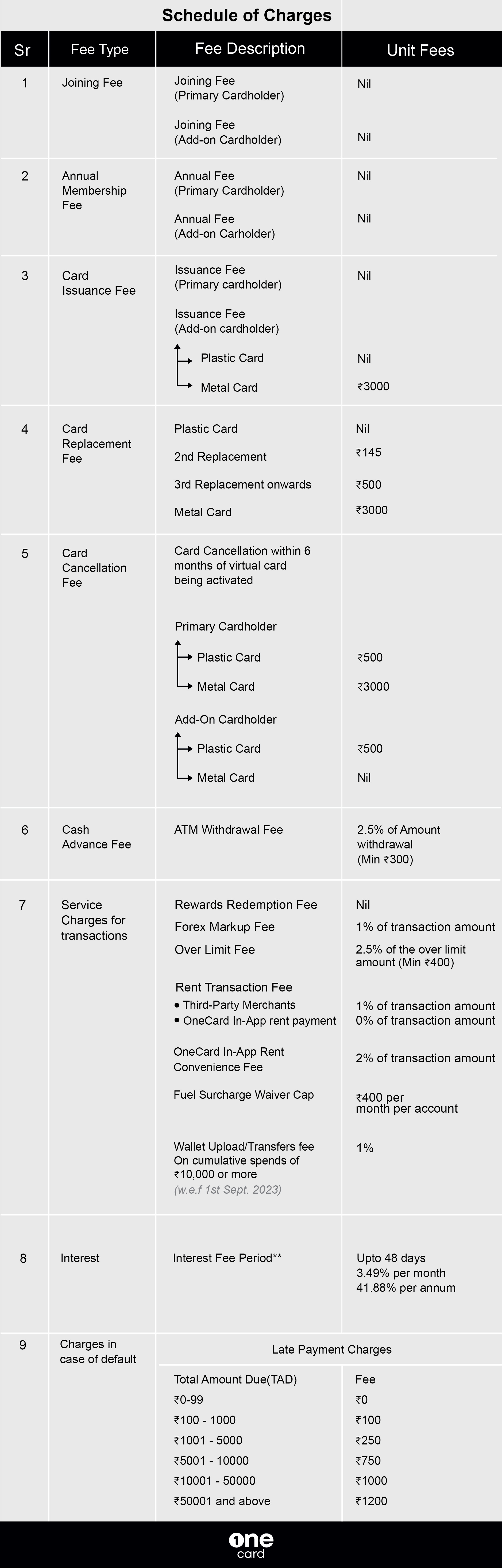

A) FEES AND CHARGES 👀

We believe in keeping your life simple and our charges reflect our endeavor in that direction.As long as you use the CSB OneCard Credit Card within your approved credit limit, and pay the full outstanding by the due date, we wont charge you anything. However, in cases of delays in payments or part payments or using your card beyond the limit, there would be some charges levied.

Here’s a list of these charges:

Goods and Services Tax (GST) is applicable on all fees, interest and other charges and is subject to change as and when notified by the Government of India

* Cash Withdrawal from ATMs

You can use the CSB OneCard Credit Card to withdraw cash from ATMs in India and/or overseas (except foreign currency transactions in Nepal and Bhutan) in accordance with the compatibility of the CSB OneCard Credit Card at the said ATM(s). Cash withdrawal charges or ATM withdrawal fee as mentioned above shall be levied on all such withdrawals and would be billed to you in the next/forthcoming CSB OneCard Credit Card statement.

** Interest Free Period

Please remember that this facility of an interest free period will not be available to you if you have not paid the previous month’s outstanding amount in entirety.

*** Interest Rate

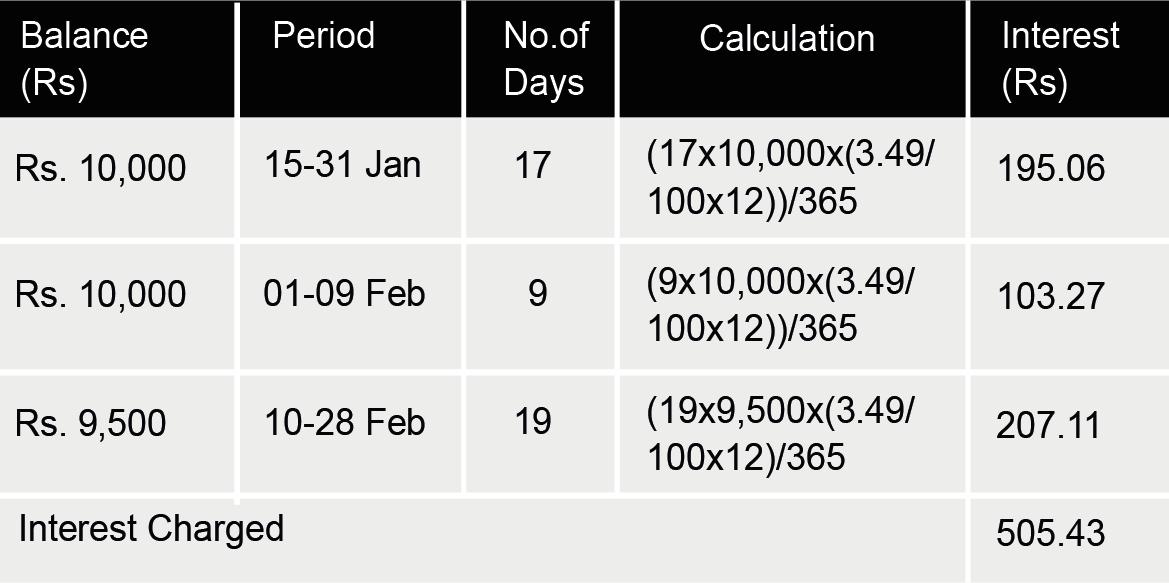

At the end of each day, the current balance/outstanding amount will be multiplied by the daily rate to arrive at the daily interest charges, which then get added to your outstanding balance. A simple formula would be as below: ((Number of days X Entire outstanding amount X (Interest rate per month x 12 months))/365 days. Currently, the interest rate on unpaid dues is 41.88% per annum, or 3.49% per month, for all CSB OneCard Credit Card members on their unpaid dues.

Sample Illustration 1 (dues not paid in full)

Purchase: Rs.10,000 on January 15, 2021

Statement Date: February 01, 2021

Total Amount Due: Rs.10,000

Payment Due Date: February 18, 2021

Payment Done: Rs.500 on February 10, 2021

No other transactions in February.

As per the formula shared above, the interest will be charged as follows:

Goods & Services Tax (GST) at the prevailing rate (currently 18%) will be levied on this interest charged, which is Rs. 90.98.

This will be added to the outstanding amount so in your statement on March 01, 2021, the Total Amount Due will be Rs.10,096.41 (Rs.9,500 + Rs. 505.43 + Rs.90.98)

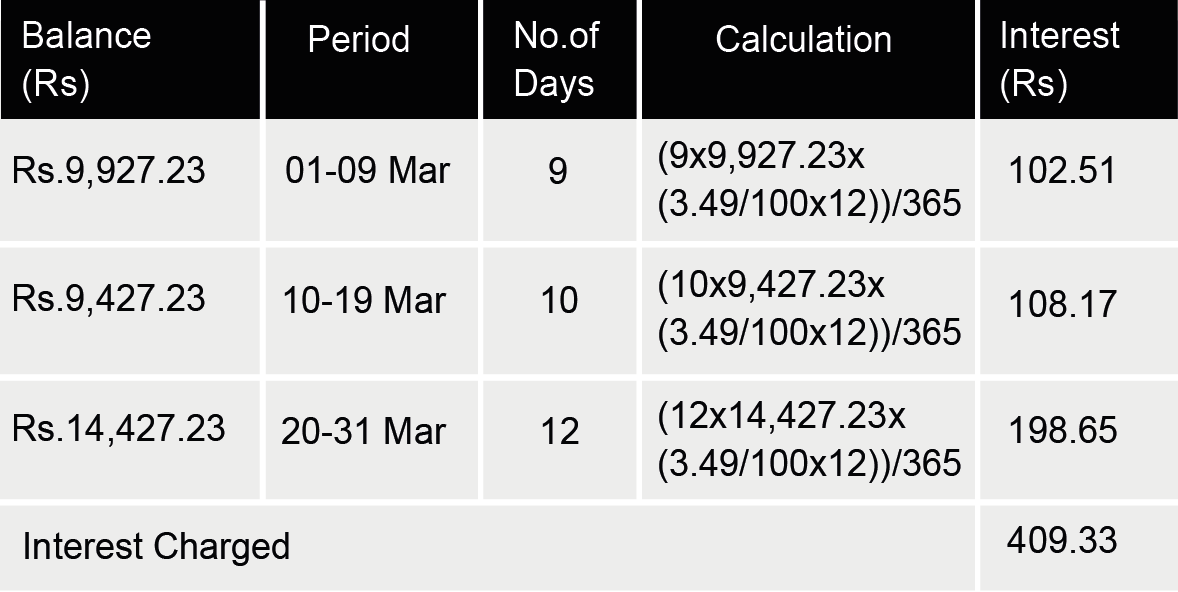

Sample Illustration 2 (Dues revolved, fresh purchase)

Statement Date: March 01, 2021

Total Amount Due: Rs.9,927.23

Payment Due Date: March 18, 2021

Payment Done: Rs.500 on March 10, 2021

New Purchase: Rs.5,000 on March 20, 2021

Interest will be charged as follows:

Goods & Services Tax (GST) at the prevailing rate (currently 18%) will be levied on this interest charged, which is Rs.73.68.

This will be added to the outstanding amount so in your statement on April 01, 2020, the Total Amount Due will be Rs.14,910.24 (Rs.14,427.23 + Rs. 409.33 + Rs.73.68).

Note: These illustrations are meant to be indicative and to show how interest is calculated and charged. Actual amounts can vary depending on specific cases.

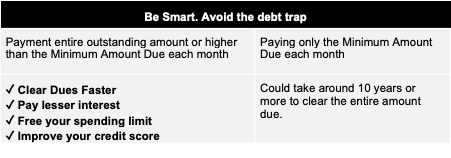

The Minimum Amount Due is a variable percentage of Net Debits + Full Over. The Limit amount + EMI billed for the month inclusive of EMI interest, fees and taxes + Previous statement unpaid minimum amount dues if any.

The Minimum Amount Due variable percentage can range between (5% - 100%) and will be based upon the cardholder’s repayment status.

The Interest rates are subject to changes made by the Bank and Reserve Bank of India from time to time.

**** Late Payment Fee

You are charged a Late Payment Fee if there has been no payment or a payment less than the Minimum Amount Due is received by the Payment Due Date.

Example:

Consider the Total Amount Due (TAD) is Rs.5,000 and Payment Due Date is 4 May, 2020. In case the cardholder does not pay the Minimum Amount Due by the Payment Due Date, a Late Payment Fee of Rs. 250 will be levied on the next bill due date. Late Payment Fee is Rs 250 if the TAD is in the range of 1001-5000.

Forex Markup Fee:

When you use your CSB OneCard Credit Card to transact in a foreign currency, that transaction amount is converted to Indian Rupees (INR) on the settlement date. This could be different from your transaction date.

If the transaction is not in USD (US Dollars), the amount will first be converted to USD, and then the USD amount will be converted to INR as per rate provided by MasterCard. On this amount, a forex markup fee will be levied, and GST will be applicable on the markup fee. If this transaction is reversed within 30 days, the markup fee and GST will be reversed to the cardholder.

A forex markup fee will also be levied in case of an Indian Rupee (INR) transaction done at a merchant or payment gateway that is based out of India.

EMI Conversion:

In the event, if you wish to convert any of the transactions into equated monthly installment (EMI), the applicable charges and details of these EMIs are governed by the EMI terms and conditions.

B) DRAWAL LIMITS 💸

Your Credit Limit and Cash Withdrawal Limit are both dynamic. You can request for an increase in your credit limit from the OneCard app if you’re eligible for this option. Once approved, this revised amount would be your new Credit Limit.

Bank also reserves the right to recommend a credit limit increase to you based on your CSB OneCard Credit Card usage, inside the OneCard app. This recommendation and its associated Terms and conditions will be made available to you to consider before accepting the recommendation.

Once you read and agree to the Terms related to credit limit increase displayed inside the OneCard app and provide your consent to increase the limit, the credit limit on your card will be enhanced through the systems. Your acceptance of the limit increase recommendation received through electronic means inside the OneCard app where you specifically validate the limit increase and agree to the MITC will be treated as a consent.

Bank and/ or its authorised service providers will keep the digital records of such consent and will treat it as proof of consent in case of any dispute arising later on account of limit increase.

Bank will review your account periodically and reserves the right to decrease your credit limit based on your transaction patterns, repayment behavior and other internal criteria. This will be informed to you via the OneCard app and/or via email and SMS.

“Available Credit Limit” or “Available Cash Limit” is the limit up to which you can make purchases or withdraw cash from an ATM respectively. The Cash Limit is a part of the overall Credit Limit assigned to you though unavailable to cardholders for the time being. An intimation will be shared once it is enabled.

C) BILLING 📅

i) Billing statements (periodicity and mode of sending)

Your billing statement will be generated every month (5th/18th) and can be modified to a different date (5th/18th) once as per your convenience. You can view the statement in the OneCard app. It will contain a break-up of all purchases, repayments, fees, interest charges, refunds and taxes. In case the CSB OneCard Credit Card was not used in a month, the statement will mention there were no spends in that month. The OneCard app also has an option to view the statement in PDF format, which can then be downloaded. The billing statement will be sent to the registered E mail ID as well if you opt so. The billing statement shall be deemed to be a demand notice for payment and no separate intimation would be made in this regard.

ii) Minimum Amount Due

When you get your Statement (currently on 5th/18th ) , you can choose to pay the Total Amount Due (TAD) or the Minimum Amount Due (MAD) as per your statement. The remaining balance can be carried forward to subsequent months. This Minimum Amount Due will be:

i) 5% of the outstanding amount or Rs.100 (whichever is greater) PLUS

ii) Previous unpaid minimum amount dues, if any; PLUS

iii) Any amount exceeding the credit limit; PLUS

iv) Entire amount of any installments (EMI) due (if/as applicable)

You can also pay the Total Amount Due or an amount between the Minimum Amount Due and Total Amount Due. Payment should be made before Payment Due Date to avoid Late Payment Charges.

When you make a payment, it is adjusted in this order:

Billed Cash Advance Fees with Interest and Taxes ⏩ Billed Purchases with Fees, Interest and Taxes (as applicable) ⏩ UnBilled Cash Advance Fees with Interest and Taxes ⏩ UnBilled Purchases with Fees, Interest and Taxes (as applicable).

Within these, the payment is further adjusted as below:

Taxes ⏩ Fees ⏩ Interest ⏩ Purchases.

If Total Amount Due is less than Rs.100, Minimum Amount Due would be equal to the Total Amount Due, ie. Rs.100.

iii) Refunds/Chargebacks/Reimbursements

You must pay for the transactions billed in the CSB OneCard statement to avoid any additional charges being levied. Any refunds, chargebacks or reimbursements which are not shown in the CSB OneCard statement, should not be adjusted or reduced by you from the Total Amount Due (TAD) on your own when making the payment. Refunds/chargebacks/reimbursements if any, will be reflected in your CSB OneCard Account, as and when such refunds/chargeback/reimbursement are received and these will be adjusted against your dues in your next CSB OneCard statement.

iv) Method of payment

You can pay the outstanding dues from the OneCard app itself, through the following modes:

a) Debit Card b) Netbanking c) UPI

You can also make the payment via IMPS or NEFT to the unique CSB OneCard Credit Card bank account number provided in the app.

(v) Billing disputes resolution

All the contents of the statement will be deemed to be correct and accepted if you do not inform us of any discrepancies within 30 days of the statement date. In the event of billing disputes/discrepancies, we shall investigate and confirm the liability for such transactions. For certain disputes, we may offer a temporary credit during the period of investigation, which may be reversed along with applicable charges subject to outcome of the investigation. GST levied will not be reversed on any dispute on fees and charges or interest.

(vi) Contact particulars of card issuer

Card Issuer Contact Details : https://www.csb.co.in/contact-us

In case you need any help or want to raise a grievance, you can:

📱 Select “Need Help?” from the Profile section in the OneCard App

📧 Email your query or concern to help@getonecard.app

📞 Call us on our helpline number at 1800-210-9111

🏢 Write in: FPL Technologies Pvt. Ltd., Disha Bldg, Survey No 127, Mahavir Park, Opposite Sarjaa, Aundh, Pune 411007

(vii) Grievance Redressal Escalation

The Grievance will be acknowledged via registered Email with a unique grievance reference number Response to the grievance will be offered in 7 working days and the same will be intimated via registered Email.

If you are not satisfied with the response from regular channels, you can send an email to grievances@fplabs.tech and a response will be offered in 7 working days and intimated to the registered E mail.

Beyond this level, you can reach out to the bank as per their complaint redressal system as detailed below.

| Escalation | Contact No. | |

|---|---|---|

| CSB Bank | customercare@csb.co.in | 18002669090 |

If the issue remains unresolved beyond 30 days even after reaching out to the above channels, or if the response is unsatisfactory, you may write to the Banking Ombudsman for an independent review. Details of the Banking Ombudsman Scheme are available on the Reserve Bank of India (RBI) website at https://www.rbi.org.in/

viii) Refund of credit balance/excess amount

Any excess credit arising out of refund / failed / reversed transactions will be transferred back to the account added by the cardholder in the OneCard App beyond a cutoff (1% of credit limit or Rs. 5000 whichever is lower). Due diligence will be done on any suspicious refund/reversal transactions and on validation processing will be done.

a) if this credit balance/excess amount is to be refunded, the following procedure must be followed by you:

- Cardholder must add the bank account in profile section of the Onecard app by entering the bank account and IFSC code.

- Any excess refund / reversal amount will be sent only to the added bank account. If cardholder wishes to adjust the excess refund/reversal amount against purchases on the CSB Onecard Credit Card, cardholder should connect with the customer experience team.

b) If the credit balance/excess amount is due to an additional repayment, it will be reversed within 7-10 working days into the source account from which the cardholder made the repayment

c) If the CSB OneCard Credit Card account stands canceled, the credit balance/excess amount will be refunded to the cardholder’s savings bank account as per the procedure outlined in clause a) above.

d) No interest will be payable on any credit balance/excess amount lying in the Cardholder’s CSB OneCard Credit Card account.

e) Cardholders are not permitted to make excess payment into their CSB OneCard Credit Card account to artificially enhance their sanctioned credit limit for honoring high value transactions. In case there is a need for enhancement of credit limit, a request can be placed separately for that.

D) DEFAULT AND CIRCUMSTANCES 😩

i) Procedure including notice period for reporting a cardholder as defaulter

If you do not pay at least the Minimum Amount Due 3 days after the Payment Due Date, the card will be reported as delinquent by the Bank to the Credit Information Companies (CICs), authorized by the Reserve Bank of India (RBI). Non-payment of Minimum Amount Due may also lead to discontinuation of the credit card services.

ii) Procedure for withdrawal of default report and the period within which the default report would be withdrawn after settlement of dues

Once reported to the Credit Information Companies (CICs) there is no withdrawal of the report. However, if dues are settled by you, this information will be provided to the Bank for sharing with Credit Information Companies (CICs) in the subsequent month.

iii) Recovery procedure in case of default

In the event of a default, you will be sent reminders by any of the following methods such as SMS, email, telephone and WhatsApp for settlement of any outstanding dues. If no response is received from you via regular channels, third parties may be engaged to remind, follow up and collect dues. A message may be left with your spouse / parent / other direct adult family member / secretary / accountant or other colleague, as available, at your residence / office / phone. Any such third party appointed shall adhere fully to the code of conduct on debt collection.

(iv) Recovery of dues in case of accidental death of Cardholder

In case of accidental death of the primary cardholder, the complete outstanding balance (including unbilled transactions) will become immediately due and payable to the Bank. Bank will follow up with Cardholder’s legal heirs, informing them about the outstanding amount and requesting them to clear those dues.

(v) Recovery in case of natural death of Cardholder

Recovery of dues in case of natural death / permanent in capacitance of the

cardholder: The complete outstanding balance (Including unbilled transactions) will become immediately due and payable to the Bank. The Bank will be entitled to recover the total outstanding from the estate of the cardholder. The Bank will also be entitled to recover the total outstanding from Legal heirs /monies / deposits / accounts maintained in the cardholder’s name with any financial institution and the card members assigns rights of recovery of his dues directly to the Bank.

E) TERMINATION/REVOCATION OF CARD MEMBERSHIP 😢

i) Procedure for surrender of card by Cardholder - due notice –

a) You can close your CSB OneCard Credit Card account any time by calling the Customer Care team at 1800 210 9111 or by writing an email at help@onecard.app. The entire card outstanding dues and loans / EMI facilities linked to your CSB OneCard Credit Card (if applicable and/or availed of) will immediately become due.

b) Any refund/reversal that is received after the card closure will be intimated to you and refunded electronically to the account number shared with customer care after verifying the ownership.

c) Once the virtual CSB OneCard Credit Card is activated, the physical card will be sent to you. If you choose to cancel card membership within 6 months of activating the virtual card, a charge of Rs. 3,000 will be levied. This would be added to the overall outstanding amount and the card account will be closed once all dues are paid and recorded in the Bank’s system.

d) Upon termination/revocation of CSB OneCard Credit Card membership for any reason whatsoever, whether at the instance of the cardmember or otherwise, the cardmember shall remain liable for all purchase amount debits and charges incurred by the use of the CSB OneCard Credit Card.

e) You specifically acknowledge that once your CSB OneCard Credit Card account is closed, the privileges (including but not limited to all benefits and services accrued, reward points not redeemed etc) of the CSB OneCard Credit Card stand nullified. Reinstatement of the same is neither automatic nor attendant and will take place solely at the discretion of the Bank.

f) For avoiding misuse, it is advised to destroy the terminated/expired/cancelled CSB OneCard Credit Card ensuring that the hologram, magnetic strip and chip are destroyed permanently.

g) Your CSB OneCard Credit Card account will be closed only once the Bank receives the payment of all amounts due and outstanding in respect of the said CSB OneCard Credit Card account.

h) You can call the customer care via phone on 1800 210 9111 or raise a ticket in the OneCard app for initiating closure of card subject to the outstanding dues being cleared.

ii) Procedure for revocation of card membership

Your access to your CSB OneCard Credit Card may be cancelled or revoked at any time without prior notice, if we consider it necessary for business or security reasons, which may include but are not limited to:

a) Delayed or dishonored payments, improper use of credit card (in violation of RBI and Foreign Exchange rules).

b) Misleading or incorrect information / documents given along with card application.

c) Failure to furnish information or documents as required under the Know Your Customer (KYC)/ Anti Money Laundering (AML)/ Combating the Financing of Terrorism (CFT) guidelines.

d) Involvement in any civil litigation or criminal offense / proceedings by any authority, court of law or professional body or association.

e) Changes in credit policy due to prevailing conditions / unforeseen circumstances.

Credit scores below the level as fixed from time to time

You may continue to get your CSB OneCard Credit Card statements with actual outstanding, even after closure of the card account.

f)In case your CSB OneCard Credit Card has not been used for more than one year then we will notify you of the dormancy within 30 days. If the card is still not used or no reply is received for the continuation of CSB OneCard Credit Card, CSB OneCard Credit Card will be closed and reported to the bureau, subject to payment of all dues by the cardholder .

F) LOSS/THEFT/MISUSE OF CARD 😠

i) Procedure to be followed in case of loss/theft/misuse of card

In case your CSB OneCard Credit Card is lost, stolen, misplaced, or if the credit card PIN has been compromised, report this immediately from the OneCard app or via phone on 1800-210-9111 or email us on help@getonecard.app.

If your CSB OneCard Credit Card is misplaced, you can lock the card temporarily from the OneCard app.

If your CSB OneCard Credit Card is lost or stolen, you can block the CSB OneCard Credit Card from the OneCard app and a new card will be sent to you. You can also reset the Card PIN from the OneCard app.

In case the mobile phone with the OneCard app is lost or stolen, inform us immediately by calling on 1800-210-9111. Please also report the theft of the CSB OneCard Credit Card or phone to the police by lodging a First Information Report (FIR) and share a copy of that with us when requested.

If you wish to change the registered mobile number or e-mail address, you can intimate us by sending an email to help@getonecard.app.

ii) Liability of cardholder in case of (i) above is in terms of RBI circular ref. DBR.No.Leg.BC.78/09.07.005/2017-18 dated July 6, 2017 on ‘Customer Protection – Limiting Liability of Customers in Unauthorised Electronic Banking Transactions’ as updated from time to time.

A.You will be entitled for Zero Liability where the unauthorized transactions occur in the following events:

1.Contributory Fraud/Negligence/Deficiency on our part.

2.Third Party breach where the deficiency lies elsewhere in the system and you notify us within 3 working days of receiving the communication from us regarding the unauthorized transaction.

B. You shall be liable for the loss occurring due to unauthorized transactions in the following cases:

1.In cases where the loss is due to your negligence such as where you have shared the payment credentials, you will bear the entire loss until you report the unauthorized transaction to us. Any loss occurring after the reporting of the unauthorized transaction shall be borne by us.

2.In cases where the responsibility of the unauthorized electronic banking transaction lies neither with us nor you, but lies elsewhere in the system and when there is a delay (of 4-7 working days after receiving communication from us) on your part in notifying us of such a transaction, your per transaction liability shall be limited to the transaction value or the amount whichever is lower as mentioned in the table below

3.Further, if the delay in reporting by you is beyond 7 working days, the customer liability shall be determined as per the Bank’s Board approved policy.

|

|||||||||||||||||||

NEVER share your OneCard App PIN and credit card PIN with anyone!

G) DISCLOSURES 📣

i) Bank will share credit information including but not limited to the current balance, loans / EMI facilities linked to the CSB OneCard Credit Card (if applicable and/or availed of), balance outstanding on the CSB OneCard Credit Card / loan, payment history etc. with Credit Information Companies (CICs) authorised by RBI, as per the Credit Information Companies (Regulation) Act, 2005.

ii) Certain activities in relation to your CSB OneCard Credit Card are outsourced by the Bank to the FPL Technologies Private Limited (“FPL”) which is an authorised outsourced technology service provider of the Bank. FPL manages the CSB OneCard Credit Card for the Bank as authorised by the Bank.

iii) All references to “We” or “we” in these Terms shall mean and include the Bank, Oneconsumer Services Private Limited and/ or Bank’s authorised service providers such as FPL Technologies Private Limited.

iv) Banks have all responsibility for adherence to all regulatory rules, directions, and guidelines including guidelines on outsourcing of financial services by banks or NBFCs issued by the RBI. We do not provide any services in contravention of the guideline on outsourcing of financial services by banks or NBFCs issued by the RBI.

v) Bank will provide particulars of the CSB OneCard Credit Card account to the statutory authorities, as needed.

vi) Transaction alerts received may not be assumed as a confirmation of transaction completion.

vii) If you do not wish to receive any marketing calls/emails from us for other products, you can register for the Do Not Disturb service and also unsubscribe from promotional emails by clicking on the link which will be provided in such emails.

viii) You will continue to receive communications about transactions and core features of CSB OneCard Credit Card. A copy of this MITC document, Terms and Conditions, and FAQ will always be available on www.getonecard.app.

ix) The arrangement between Oneconsumer Services Private Limited and the Bank for issuance of the co-branded credit card involves sharing of revenues in respect of such co-brand credit card.

H) Grievance Redressal and Compensation Framework

i) Grievance redressal and escalation process and Timeline for redressal of grievance

a) Timeline for redressal of grievance

If your grievance is not satisfactorily resolved after reaching out to grievances@fplabs.tech, you can reach out to the bank as per their escalation matrix as detailed above .

If the issue remains unresolved beyond 30 days even after reaching out to the above channels, or if the response is unsatisfactory, you may write to the Banking Ombudsman for an independent review. Details of the Banking Ombudsman Scheme are available on the Reserve Bank of India (RBI) website at https://www.rbi.org.in/

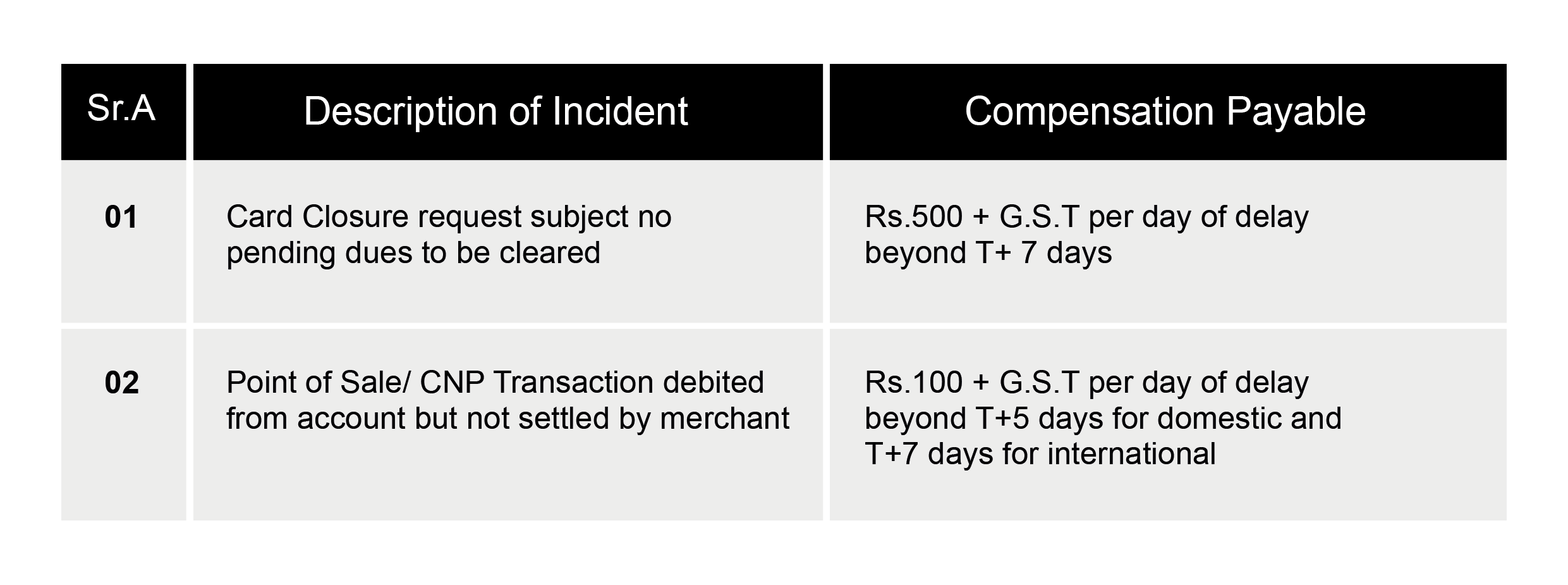

ii) Below compensation framework will be followed in case of delay in resolving

iii) Contact details of the card-issuer are as following

Card Issuer Contact Details : https://www.csb.co.in/contact-us

📧 Email your query or concern to help@getonecard.app

📞 Call us on our helpline number at 1800-210-9111

🏢 Write in: FPL Technologies Pvt. Ltd., Disha Bldg, Survey No 127, Mahavir Park, Opposite Sarjaa, Aundh, Pune 411007

If you are not satisfied with the response from regular channels, you can send an email to grievances@fplabs.tech

I) REWARD POINTS 🎁

By using your CSB OneCard Credit Card, you are automatically enrolled in the OneCard Rewards Programme. When you transact with your CSB OneCard Credit Card, reward points are credited to your CSB OneCard Credit Card account depending on the transaction value and the purchase category. These reward points can be accumulated and further used to repay other purchases or redeemed for exciting offers shown in the OneCard app from time to time. Please refer to the terms and conditions to view further details on the rewards programme.

J) Classification as Special Mention Account (SMA) and Non-Performing Asset (NPA)

With reference to the financial assistance/credit facility in the form of CSB OneCard Credit Card being availed by me on the date hereof issued by CSB Bank Ltd., I hereby confirm having understood the concepts and illustrative examples (as detailed below) relating to due dates, classification of borrower accounts as Special Mention Account (“SMA”) or Non Performing Asset (“NPA”) in the course of the conduct of the accounts.

Concepts / clarifications / Illustrative examples on due dates and specification of SMA / NPA classification dates.

Dues: Dues mean, the principal / interest / any charges levied on the loan account which are payable within the period stipulated as per the terms of sanction of the credit facility.

Overdue: Overdue mean, the principal / interest / any charges levied on the loan account which are payable but have not been paid 13 within the period stipulated as per the terms of sanction of the credit facility. In other words, any amount due to the Bank under any credit facility is ‘overdue’ if it is not paid on the due date fixed by the Bank.

Lending institution (i.e. CSB Bank Ltd. ) will recognize the incipient stress in loan accounts, immediately on default, by classifying them as SMA. The basis of classification of SMA category shall be as follows:

|

|||||||||||||||||||

Non-performing Asset:

I. A credit card account will be treated as non-performing asset if the minimum amount due, as mentioned in the statement, is not paid fully within 90 days from the payment due date mentioned in the statement.

II. Illustrative movement of an account to SMA category to NPA category based on delay /nonpayment of dues and subsequent upgradation to standard category at day end process:

Due date of payment |

Payment Date |

Payment Covers |

Age of oldest dues in days |

SMA / NPA Categorization |

SMA since Date SMA class date |

NPA Categorization |

NPA Date |

|---|---|---|---|---|---|---|---|

| 01.01.2022 | 01.01.2022 | Entire dues upto 01.01.2022 | 0 | NIL | NA | NA | NA |

| 01.02.2022 | 01.02.2022 | Partly paid dues of 01.02.2022 | 1 | SMA 0 | 01.02.2022 | NA | NA |

| 01.02.2022 | 02.02.2022 | Partly paid dues of 01.02.2022 | 2 | SMA 0 | 01.02.2022 | NA | NA |

| 01.03.2022 | Dues of 01.02.2022 not fully paid 01.03.2022 is also due at EOD 01.03.2022 |

29 | SMA 0 | 01.02.2022 | NA | NA | |

Dues of 01.02.2022 fully paid. Due for 01.03.2022 not paid at EOD 01.03.2022 |

1 | SMA 0 | 01.03.2022 | NA | NA | ||

| No payment of full dues of 01.02.2022 and 01.03.2022 at EOD 03.03.2022 | 31 | SMA 1 | 01.02.2022/03.03.2022 | NA | NA | ||

| Dues of 01.02.2022 fully paid. Duefor 01.03.2022 not fully paid at EOD 01.03.2022 | 1 | SMA 0 | 01.03.2022 | NA | NA | ||

| 01.04.2022 | No payment of dues of 01.02.2022, 01.03.2022 and amount due on 01.4.2022 at EOD 01.04.2022 |

60 | SMA 1 | 01.02.2022 / 03.03.2022 | NA | NA | |

| No payment of dues of 01.02.2022 till 01.04.2022 at EOD 02.04.2022 | 61 | SMA 2 | 01.02.2022 / 02.04.2022 | NA | NA | ||

| 01.05.2022 | No payment of dues of 01.02.2022 till 01.05.2022 at EOD 01.05.2022 |

90 | SMA 2 | 01.02.2022 / 02.04.2022 |

NA | NA | |

No payment of dues of 01.02.2022 till 01.05.22 at EOD 02.05.2022 |

91 | NPA | NA | NPA | 2.05.2022 | ||

| 01.06.2022 | 01.06.2022 | Fully Paid dues of 01.02.2022 at EOD 01.06.2022 |

93 | NPA | NA | NPA | 2.05.2022 |

| 01.07.2022 | 01.07.2022 | Paid entire dues 01.03.2022 & 01.04.2022 atEOD 01.07.2022 | 62 | NPA | NA | NPA | 2.05.2022 |

| 01.08.2022 | 01.08.2022 | Paid entire dues of 01.05.2022 & 01.06.2022 at EOD 01.08.2022 |

32 | NPA | NA | NPA | 2.05.2022 |

| 01.09.2022 | 01.09.2022 | Paid entire dues of 01.07.2022 & 01.08.2022 at EOD 01.09.2022 but not paid the dues of 01.09.2022 |

1 | NPA | NA | NPA | 2.05.2022 |

| 01.10.2022 | 01.10.2022 | Paid entire dues of 01.09.2022 & 01.10.2022 |

0 | Standard account with no overdues |

NA | NA | STD from 01.10.2022 |

l/we also understand that the aforesaid few examples are illustrative and not exhaustive in nature covering common scenarios, and that, the IRACP norms and clarifications provided by RBI on the subjects referred above will prevail.

IMPORTANT REGULATORY INFORMATION

i) Your CSB OneCard Credit Card is valid for use both in India as well as abroad. It is, however, not valid for making foreign currency transactions in Nepal and Bhutan.

ii) Foreign exchange trading through Internet trading portals is not permitted. In the event of any violations or failure to comply, you may be liable for penal action and/or closure of the card.

Declaration And Consent

I hereby acknowledge that I have applied for the CSB OneCard Credit Card issued by the Bank pursuant to a co-branded partnership with Oneconsumer Services Private Limited and declare that I am a resident Indian over 18 years of age. I declare that all the particulars and information given as part of application are true, correct and complete and that Bank and/or its authorised service provider is entitled to verify these details directly or through any third-party agent. I further understand that Bank and/or its authorised service provider may at its sole discretion sanction or decline this application for the CSB OneCard Credit Card, without assigning any reason whatsoever. I undertake to inform Bank and/or its authorised service provider regarding any change in my application credentials originally submitted and to provide any further information that they may require to process the Application and/or continued usage on the CSB OneCard. I hereby authorize and give express consent to Bank and /or its authorised service provider to disclose, without notice to me, my Personally Identifiable Information (PII) and other Non-Personally Identifiable Information (NII) furnished by me in any application form(s) or related documents executed or furnished by me in relation to the CSB OneCard Credit Card to other branches of the Bank, subsidiaries or affiliates of the Bank, Credit Information bureaus, rating agencies, service providers, service partners (including any insurance partners) other banks or financial institution, governmental/ regulatory authorities or third parties for KYC verification , bank account statement verification, credit risk analysis, or for other related purposes that Bank and/or its authorised service provider may deem fit to process my application and/or for continued usage of the CSB OneCard Credit Card and/ or for any other marketing objectives. I hereby specifically waive the privilege of privacy and privity of contract.