The One Credit Card Terms and Conditions (In Hindi)

These Most Important Terms and Conditions apply to Federal Bank One Co-Branded Credit Card issued by Federal Bank Limited (Bank) in partnership with its co -branding partner Oneconsumer Services Private Limited (** Federal Bank One Co-Branded Credit Card **). Your Federal Bank One Co-Branded Card Credit Card is managed by FPL as authorized by Bank which is the outsourced service provider of the Bank.

Activating your card from the OneCard app or clicking on ‘Submit’ or ‘I Agree’ or any similar tab/icon would mean acceptance of the below terms and conditions by the cardholder/cardmember/user (You).

The MITCs are in addition to and are to be read along with the detailed Terms and Conditions, and are subject to changes from time to time. The most recent version will always be available on this website.

Welcome to a world of convenience!

The OneCard Mobile App📱

You can control the Federal Bank One Co-Branded Card Credit Card entirely from the powerful OneCard Mobile App, some of the actions being:

- Set your App PIN

- Activate your Federal Bank One Co-Branded Card Credit Card

- Make credit card bill payments

- Manage your virtual credit card

- Control your credit and cash withdrawal limits

- Enable online, domestic and international usage

- Set your Federal Bank One Co-Branded Card Credit Card PIN (For use at Point of Sale and ATMs)

- Raise disputes or service queries on any aspect of your Federal Bank One Co-Branded Card Credit Card

We have ensured that you can do the above transactions only in a secure environment after you authenticate yourself with your preferred authentication mechanism (Fingerprint/PIN). As a cardholder, you should be aware of the features and impact of these transactions as you would be responsible for your actions within the OneCard App.

Virtual Credit Card 💳📲

In addition to the physical Federal Bank One Co-Branded Card Credit Card, you will receive as part of the on-boarding process, a virtual rendition of the same Federal Bank One Co-Branded Card Credit Card which will be available on the OneCard App.

This virtual card is also a VISA powered credit card so that you can use it for any online or mobile application-based transactions or purchases. The security parameters are set as per industry standards.

A) FEES AND CHARGES 👀

We believe in keeping your life simple and our charges reflect our endeavour in that direction.

As long as you use the Federal Bank One Co-Branded Card Credit Card within your approved credit limit, and pay the full outstanding by the due date, we won’t charge you anything. However, in cases of delays in payments or part payments or using your card beyond the limit, there would be some charges levied.

Here’s a list of these charges:

Goods and Services Tax (GST) is applicable on all fees, interest and other charges and is subject to change as and when notified by the Government of India

* Cash Withdrawal from ATMs

You can use the Federal Bank One Co-Branded Card Credit Card to withdraw cash from ATMs in India and/or overseas (except foreign currency transactions in Nepal and Bhutan) in accordance with the compatibility of the Federal Bank One Co-Branded Card Credit Card at the said ATM(s). Cash withdrawal charges or ATM withdrawal fee as mentioned above shall be levied on all such withdrawals and would be billed to you in the next/forthcoming Federal Bank One Co-Branded Card Credit Card statement.

** Interest Free Period

Please remember that this facility of an interest free period will not be available to you if you have not paid the previous month’s outstanding amount in entirety.

*** Interest Rate

At the end of each day, the current balance/outstanding amount will be multiplied by the daily rate to arrive at the daily interest charges, which then get added to your outstanding balance. A simple formula would be as below: ((Number of days X Entire outstanding amount X (Interest rate per month x 12 months))/365 days. Currently, the interest rate on unpaid dues is 41.88% per annum, or 3.49% per month, for all Federal Bank One Co-Branded Card Credit Card members on their unpaid dues. W.e.f 01.08.2024, the interest rate on unpaid dues is 45% per annum, or 3.75% per month, for all Federal Bank One Co-Branded Card Credit Card members on their unpaid dues.

Sample Illustration 1 (dues not paid in full)

Purchase: ₹ 10,000 on January 15, 2021 Statement Date: February 01, 2021 Total Amount Due: ₹ 10,000 Payment Due Date: February 18, 2021

Payment Done: ₹ 500 on February 10, 2021

No other transactions in February.

As per the formula shared above, the interest will be charged as follows:

| Balance | Period | No. of Days | Calculation | Interest (₹) |

|---|---|---|---|---|

| ₹ 10,000 | 15-31 Jan | 17 | (17×10000 × (3.75 / 100 × 12)) / 365 | 209.59 |

| ₹ 10,000 | 01-09 Feb | 9 | (9×10000 × (3.75 / 100 × 12)) / 365 | 110.96 |

| ₹ 9,500 | 10-28 Feb | 19 | (19×9500 × (3.75 / 100 × 12)) / 365 | 222.53 |

| Interest Charged | 543.08 |

Goods & Services Tax (GST) at the prevailing rate (currently 18%) will be levied on this interest charged, which is ₹ 97.75.

This will be added to the outstanding amount so in your statement on March 01, 2021, the Total Amount Due will be ₹ 10,140.84 (₹ 9,500 + ₹ 543.08 + ₹ 97.75)

Sample Illustration 2 (Dues revolved, fresh purchase)

Statement Date: March 01, 2021 Total Amount Due: ₹ 9,927.23 Payment Due Date: March 18, 2021

Payment Done: ₹ 500 on March 10, 2021

New Purchase: ₹ 5,000 on March 20, 2021

Interest will be charged as follows:

| Balance | Period | No. of Days | Calculation | Interest (₹) |

|---|---|---|---|---|

| ₹ 9,927.23 | 01-09 Mar | 9 | (9×9927.23 × (3.75 / 100 × 12)) / 365 | 110.15 |

| ₹ 9,427.23 | 10-19 Mar | 10 | (10×9427.23 × (3.75 / 100 × 12)) / 365 | 116.23 |

| ₹ 14,427.53 | 20-31 Mar | 12 | (12×14427.53 × (3.75 / 100 × 12)) / 365 | 213.45 |

| Interest Charged | 439.83 |

Goods & Services Tax (GST) at the prevailing rate (currently 18%) will be levied on this interest charged, which is ₹79.17.

This will be added to the outstanding amount so in your statement on April 01, 2020, the Total Amount Due will be ₹14,910.24 (₹14,427.23 + ₹439.83 + ₹79.17).

Note: These illustrations are meant to be indicative and to show how interest is calculated and charged. Actual amounts can vary depending on specific cases.

The Minimum Amount Due is a variable percentage of Net Debits + Full Over The Limit amount + EMI billed for the month inclusive of EMI interest, fees and taxes + Previous statement unpaid minimum amount dues if any.

The Minimum Amount Due variable percentage can range between (5% - 100%) and will be based upon the cardholder’s repayment status.

**** Late Payment Fee

You are charged a Late Payment Fee if there has been no payment or a payment less than the Minimum Amount Due is received by the Payment Due Date. Late payment fee will be levied based on Cardmember’s outstanding amount as per the below mentioned grid.

Applicable till 31.07.2024

Applicable w.e.f 01.08.2024

Example:

Consider the Total Amount Due (TAD) is ₹ 5,000 and Payment Due Date is 4 May, 2020. In case the cardholder does not pay the Minimum Amount Due by the Payment Due Date, a Late Payment Fee of ₹ 500 will be billed on the next bill due date. Late Payment Fee is ₹ 500 if the outstanding amount is in the range of 1001-5000 as per fee w.e.f <Date>.

OverLimit Fee:

Currently, the Overlimit Fee of 2.5% of the overlimit amount or ₹ 400 (whichever is higher) is charged every time the Cardmember breaches the assigned credit limit while transacting or on receipt of actual settlement amount from the merchant.

W.e.f 01.08.2024 Overlimit Fee of 2.5% of the overlimit amount or ₹ 500 (whichever is higher) will be charged every time the Cardmember breaches the assigned credit limit while transacting or on receipt of actual settlement amount from the merchant.

Transaction over limit will be allowed only if the Cardmember has enabled the overlimit card control from the App.

Forex Markup Fee:

When you use your Federal Bank One Co-Branded Card Credit Card to transact in a foreign currency, that transaction amount is converted to Indian Rupees (INR) on the settlement date. This could be different from your transaction date.

If the transaction is not in USD (US Dollars), the amount will first be converted to USD, and then the USD amount will be converted to INR as per rate provided by VISA. On this amount, a forex markup fee will be levied, and GST will be applicable on the markup fee. If this transaction is reversed within 30 days, the markup fee and GST will be reversed to the cardholder.

A forex markup fee will also be levied in case of an Indian Rupee (INR) transaction done at a merchant or payment gateway that is based out of India.

Fuel Surcharge Waiver:

When you use the Federal Bank One Co-Branded Credit Card to pay for fuel domestically, a fuel surcharge is levied by the acquirer (merchant’s bank providing terminal). The surcharge waiver will be lowest of 1% of the transaction amount or actual surcharge levied (excluding of GST). Maximum fuel surcharge waiver will be capped at ₹ 400 per calendar month per account for the fuel transactions made on Federal Bank One Co-Branded Credit Card. Such reversal will not include the applicable tax paid on such purchase. Reward Points will not be accrued on fuel transaction.

B) DRAWAL LIMITS 💸

Your Credit Limit and Cash Withdrawal Limit are both dynamic. You can request for an increase in your credit limit from the app if you’re eligible for this option. Once approved, this revised amount would be your new Credit Limit.

FPL as authorized by Bank also reserves the right to recommend a credit limit increase to you based on your Federal Bank One Co-Branded Card Credit Card usage, inside the OneCard app. This recommendation and its associated Terms and conditions will be made available to you to consider before accepting the recommendation.

Once you read and agree to the Terms related to credit limit increase displayed inside the OneCard app and provide your consent to increase the limit, FPL as authorized by Bank will enhance the credit limit on your card. Your acceptance of the limit increase recommendation received through electronic means inside the OneCard app where you specifically validate the limit increase and agree to the MITC will be treated as a consent. FPL as authorized by Bank will keep the digital records of such consent and will treat it as proof of consent in case of any dispute arising later on account of limit increase.

FPL as authorized by Bank will review your account periodically and reserves the right to decrease your credit limit based on your transaction patterns, repayment behaviour and other internal criteria. This will be informed to you via the OneCard app and/or via email and SMS.

“Available Credit Limit” or “Available Cash Limit” is the limit up to which you can make purchases or withdraw cash from an ATM respectively. The Cash Limit is a part of the overall Credit Limit assigned to you though unavailable to cardholders for the time being. An intimation will be shared once it is enabled.

C) BILLING 📅

i) Billing statements (periodicity and mode of sending)

Your billing statement will be generated every month on the billing date shown in the OneCard App and can be modified once as per your convenience from the profile section of the App. You can view the statement in the OneCard App. It will contain a break-up of all purchases, repayments, fees, interest charges, refunds and taxes. In case the card was not used in a month, the statement will mention there were no spends in that month. The app also has an option to view the statement in PDF format, which can then be downloaded from the phone.

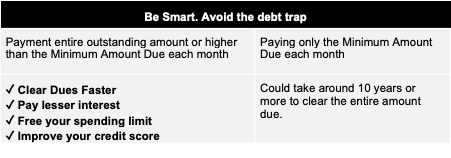

ii) Minimum Amount Due

When you get your Statement, you can choose to pay the Total Amount Due (TAD) or the Minimum Amount Due (MAD) as per your statement. The remaining balance can be carried forward to subsequent months. This Minimum Amount Due will be:

i) 5% of the outstanding amount or ₹ 100 (whichever is greater) PLUS ii) Previous unpaid minimum amount dues, if any; PLUS iii) Any amount exceeding the credit limit; PLUS iv) Entire amount of any instalments (EMI) due (if/as applicable)

You can also pay the Total Amount Due or an amount between the Minimum Amount Due and Total Amount Due. Payment should be made before Payment Due Date to avoid Late Payment Charges.

When you make a payment, it is adjusted in this order:

Billed Cash Advance Fees with Interest and Taxes ⏩ Billed Purchases with Fees, Interest and Taxes (as applicable) ⏩ UnBilled Cash Advance Fees with Interest and Taxes ⏩ UnBilled Purchases with Fees, Interest and Taxes (as applicable).

Within these, the payment is further adjusted as below:

Taxes ⏩ Fees ⏩ Interest ⏩ Purchases.

If Total Amount Due is less than ₹ 100, Minimum Amount Due would be equal to the Total Amount Due, ie. ₹ 100.

iii) Refunds/Chargebacks/Reimbursements

You must pay for the transactions billed in the Federal Bank One Co-Branded Card Credit Card statement to avoid any additional charges being levied. Any refunds, chargebacks or reimbursements which are not shown in the Federal Bank One Co-Branded Card Credit Card statement, should not be adjusted or reduced by you from the Total Amount Due (TAD) on your own when making the payment. Refunds/chargebacks/reimbursements if any, will be reflected in your Federal Bank One Co-Branded Card Credit Card Account, as and when such refunds/chargeback/reimbursement are received and these will be adjusted against your dues in your next Federal Bank One Co-Branded Card Credit Card statement.

iv) Method of payment

You can pay the outstanding dues from the App itself, through the following modes:

a) Debit Card

b) Netbanking c) UPI

You can also make the payment via IMPS or NEFT to the unique Federal Bank One Co-Branded Card Credit Card bank account number provided in the app.

(v) Billing disputes resolution

All the contents of the statement will be deemed to be correct and accepted if you do not inform us of any discrepancies within 30 days of the statement date. In the event of billing disputes/discrepancies, we shall investigate and confirm the liability for such transactions. For certain disputes, we may offer a temporary credit during the period of investigation, which may be reversed along with applicable charges subject to outcome of the investigation. GST levied will not be reversed on any dispute on fees and charges or interest.

(vi) Contact particulars of card issuer

In case you need any help, you can:

📱 Select “Need Help?” from the Profile section in the OneCard App

📧 Email your query or concern to help@getonecard.app

📞 Call us on our helpline number at 1800-210-9111

🏢 Write to us or visit us at: FPL Technologies Pvt. Ltd., West Bay, Survey No. 278, Hissa No. 4/3 Pallod Farm, Phase II, Baner, Taluka Haveli Baner Gaon, Pune - 411045, Maharashtra - India

(vii) Grievance Redressal Escalation

If you are not satisfied with the response from regular channels, you can send an email to grievances@fplabs.tech.

If your complaint has not been handled properly or there has been a delay in resolving the issue to your satisfaction, please escalate to our Principal Nodal Officer: support@federalbank.co.in

Ms. Shalini Warrier Executive Director and Principal Nodal Officer CEO's Secretariat, The Federal Bank Ltd. Federal Towers, Aluva, Kerala. Tel: 0484-2626366

If you are still not satisfied with the resolution of your complaint you can approach Banking Ombudsman. Please take note that the first point for redressal of complaints is the bank itself. The complainants may approach Reserve Bank Integrated Ombudsman through the link below. https://cms.rbi.org.in/

viii) Refund of credit balance/excess amount

In case there is a credit balance/excess amount lying in your Federal Bank One Co-Branded Card Credit Card account due to additional repayment or a refund, this amount can be adjusted against future pending dues or it can be refunded to you as per your request.

a) if this credit balance/excess amount is to be adjusted against future pending dues, no action is required by you.

b) if this credit balance/excess amount is to be refunded, the following procedure must be followed by you:

- request a refund of this credit balance/excess amount in writing by sending an email to help@getonecard.app from your registered email id, along with the reason for making a repayment in excess of the current dues

- submit the bank statement of the account from where the last two repayments towards your Federal Bank One Co-Branded Card Credit Card have been made

- submit a copy of your PAN card, if the credit balance/excess amount is more than ₹ 49,000

- if your Federal Bank One Co-Branded Card Credit Card account has been closed, provide details of the savings bank account to which the credit balance/excess amount can be refunded

c) Requests for refund of credit balance/excess amount less than ₹ 1,000 will not be processed

d) If the credit balance/excess amount is due to an additional repayment, it will be reversed within 7-10 working days into the source account from which the cardholder made the repayment

e) If the Federal Bank One Co-Branded Card Credit Card account stands cancelled, the credit balance/excess amount will be refunded to the cardholder’s savings bank account as per the procedure outlined in clause b) above. Bank account details must be provided in the email.

f) No interest will be payable on any credit balance/excess amount lying in the cardholder’s Federal Bank One Co-Branded Card Credit Card account.

g) Cardholders are not permitted to make excess payment into their Federal Bank One Co-Branded Card Credit Card account to artificially enhance their sanctioned credit limit for honouring high value transactions. In case there is a need for enhancement of credit limit, a request can be placed separately for that.

D) DEFAULT AND CIRCUMSTANCES 😩

i) Procedure including notice period for reporting a cardholder as defaulter

If you do not pay at least the Minimum Amount Due even 3 days after the Payment Due Date, the card will be reported as delinquent by the Bank to the Credit Information Companies (CICs), authorized by the Reserve Bank of India (RBI). Non-payment of Minimum Amount Due may also lead to discontinuation of the credit card services.

ii) Procedure for withdrawal of default report and the period within which the default report would be withdrawn after settlement of dues

Once reported to the Credit Information Companies (CICs) there is no withdrawal of the report. However, if dues are settled by you, this information

will be provided to the Bank for sharing with Credit Information Companies (CICs) in the subsequent month.

iii) Recovery procedure in case of default

In the event of a default, you will be sent reminders by post, telephone, email, SMS for settlement of any outstanding dues. If no response is received from you via regular channels, third parties may be engaged to remind, follow up and collect dues. A message may be left with your spouse / parent / other direct adult family member / secretary / accountant or other colleague, as available, at your residence / office / phone. Any such third party appointed shall adhere fully to the code of conduct on debt collection.

(iv) Recovery of dues in case of death of Cardholder

In case of accidental death of the primary cardholder, a waiver of the outstanding amount due up to ₹ 50,000 or as per the credit limit held by the cardholder will be offered. This will be applicable only for an active card (a card with at least one ATM/POS/E-Commerce transaction in the 90 days prior to date of death). Claim documents are to be submitted by Bank/Cardholder to ICICI Lombard General Insurance Company Limited within 60 days from the date of intimation. This waiver does not apply to any amount spent by family/friends after the primary cardholder’s death. If the outstanding amount is more than ₹ 50,000, FPL as authorized by Bank will follow up with the cardholder’s legal heirs, informing them about the outstanding amount and requesting them to clear these dues.

E) TERMINATION/REVOCATION OF CARD MEMBERSHIP 😢

i) Procedure for surrender of card by Cardholder - due notice –

a) You can close your Federal Bank One Co-Branded Card Credit Card account any time by calling the Customer Care team or by emailing help@getonecard.app them. The entire card outstanding dues and loans / EMI facilities linked to your Federal Bank One Co-Branded Card Credit Card (if applicable and/or availed of) will immediately become due.

b) Any refund/reversal that is received after the card closure will be intimated to you and refunded electronically to the account number shared with customer care after verifying the ownership.

c) Once the virtual Federal Bank One Co-Branded Card Credit Card is activated, the physical card will be sent to you. If you choose to cancel card membership within 6 months of activating the virtual card, a charge of ₹ 3,000 will be levied. This would be added to the overall outstanding amount and the card account will be closed once all dues are paid.

d) Upon termination/revocation of Federal Bank One Co-Branded Card Credit Card membership for any reason whatsoever, whether at the instance of the Cardmember or the Bank or FPL as authorized by Bank, the Cardmember shall remain liable for all charges incurred by the use of the Federal Bank One Co-Branded Card Credit Card.

e) You specifically acknowledge that once your Federal Bank One Co-Branded Card Credit Card account is closed, the privileges (including but not limited to all benefits and services accrued, reward points not redeemed etc) of the Federal Bank One Co-Branded Card Credit Card stand nullified. Reinstatement of the same is neither automatic nor attendant and will take place solely at the discretion of FPL as authorized by Bank.

f) For avoiding misuse, it is advised to destroy the Federal Bank One Co-Branded Card Credit Card ensuring that the hologram, magnetic strip and chip are destroyed permanently.

g) Your Federal Bank One Co-Branded Card Credit Card account will be closed only once FPL as authorized by Bank receives the payment of all amounts due and outstanding in respect of the said Federal Bank One Co-Branded Card Credit Card account.

h)You can call the customer care via phone on 1800-210-9111 or raise a ticket in the OneCard App for initiating closure of card subject to the outstanding dues being cleared.

ii) Procedure for revocation of card membership

Your access to your Federal Bank One Co-Branded Card Credit Card may be cancelled or revoked at any time without prior notice, if we consider it necessary for business or security reasons, which may include but are not limited to:

a) Delayed or dishonoured payments, improper use of credit card (in violation of RBI and Foreign Exchange rules).

b) Misleading or incorrect information / documents given along with card application.

c) Failure to furnish information or documents as required under the Know Your Customer (KYC)/ Anti Money Laundering (AML)/ Combating the Financing of Terrorism (CFT) guidelines.

d) Involvement in any civil litigation or criminal offence / proceedings by any authority, court of law or professional body or association.

e) Changes in credit policy due to prevailing conditions / unforeseen circumstances.

You may continue to get your Federal Bank One Co-Branded Card Credit Card statements with actual outstanding, even after closure of the card account.

f) In case your Federal Bank One Co-branded Credit Card has not been used for more than one year then we will notify you of the dormancy within 30 days. The cardholder can prevent the account from closure using any of the following methods –

Making a debit transaction (online or offline)

Provide consent in the app

Set or Modify card PIN from the app

Set or Modify transaction controls from the app

Set or Modify transaction limits from the app

Modify overlimit control from the app

Modify Swipe 2 Pay control from the app

Opt in for credit limit increase (if the option is provided to the cardholder)

F) LOSS/THEFT/MISUSE OF CARD 😠

i) Procedure to be followed in case of loss/theft/misuse of card

In case your Federal Bank One Co-Branded Card Credit Card is lost, stolen, misplaced, or if the credit card PIN has been compromised, report this immediately from the OneCard App or via phone on 1800-210-9111 or email on help@getonecard.app.

If your Federal Bank One Co-Branded Card Credit Card is misplaced, you can lock the card temporarily from the OneCard App.

If your Federal Bank One Co-Branded Card Credit Card s lost or stolen, you can block the Federal Bank One Co-Branded Card Credit Card from the OneCard App and a new card will be sent to you. You can also reset the Card PIN from the OneCard App.

In case the mobile phone with the OneCard App is lost or stolen, inform us immediately by calling on 1800-210-9111. Please also report the theft of the Federal Bank One Co-Branded Card Credit Card or phone to the police by lodging a First Information Report (FIR) and share a copy of that with us when requested.

If you change the registered mobile number or e-mail address, you can intimate us by sending an email to help@getonecard.app.

ii) Liability of cardholder in case of (i) above

A. You will be entitled for Zero Liability where the unauthorized transactions occur in the following events:

1.Contributory Fraud/Negligence/Deficiency on our part.

2.Third Party breach where the deficiency lies elsewhere in the system and you notify us within 3 working days of receiving the communication from us regarding the unauthorized transaction.

B. You shall be liable for the loss occurring due to unauthorized transactions in the following cases:

1.In cases where the loss is due to your negligence such as where you have shared the payment credentials, you will bear the entire loss until you report the unauthorized transaction to us. Any loss occurring after the reporting of the unauthorized transaction shall be borne by us.

2.In cases where the responsibility of the unauthorized electronic banking transaction lies neither with us nor you, but lies elsewhere in the system and when there is a delay( of 4-7 working days after receiving communication from us) on your part in notifying us of such a transaction, your per transaction liability shall be limited to the transaction value or the amount whichever is lower as mentioned in the table below (as per RBI)

3.Further, if the delay in reporting by you is beyond 7 working days, the customer liability shall be determined as per the bank’s Board approved policy.

Maximum Liability of the customer

| Maximum Liability of the customer | |

| — | | — |

| Reporting time of fraudulent transactions from date of receiving communication | Customer Liability |

| Within 3 working days | Zero |

| Between 4-7 working days | Credit Card limit <= 500000 : Maximum liability <= 10000

Credit Card limit > 500000 : Maximum liability <= 25000 |

| More than 7 working days | As per bank/FPL as authorized by bank’s policy |

NEVER share your OneCard App PIN and credit card PIN with anyone!

G) DISCLOSURES 📣

i) Bank will share credit information including but not limited to the current balance, loans / EMI facilities linked to the Federal Bank One Co-Branded Card Credit Card (if applicable and/or availed of), balance outstanding on the Federal Bank One Co-Branded Card Credit Card / loan, payment history etc. with Credit Information Companies (CICs) authorised by RBI, as per the Credit Information Companies (Regulation) Act, 2005.

ii) Banks have all responsibility for adherence to all regulatory rules, directions, and guidelines including guidelines on outsourcing of financial services by banks or NBFCs issued by the RBI. FPL as authorized by Bank does not provide any services in contravention of the guideline on outsourcing of financial services by banks or NBFCs issued by the RBI.

iii) FPL as authorized by Bank will provide particulars of the Federal Bank One Co-Branded Card Credit Card account to the statutory authorities and the Bank, as needed.

iv) Transaction alerts received may not be assumed as a confirmation of transaction completion.

v) If you do not wish to receive any marketing calls/emails from Oneconsumer or FPL as authorized by Bank for other products, you can register for the Do Not Disturb service and also unsubscribe from promotional emails by clicking on the link which will be provided in such emails.

vi) You will continue to receive communications about transactions and core features of Federal Bank One Co-Branded Card Credit Card. A copy of this MITC document, Terms and Conditions, and FAQ will always be available on www.getonecard.app.

H) Grievance Redressal and Compensation Framework

i) Grievance redressal and escalation process and Timeline for redressal of grievance

a) Timeline for redressal of grievance

If your grievance is not satisfactorily resolved after reaching out to grievances@fplabs.tech, you can reach out to the bank at https://www.federalbank.co.in/grievance-redressal.

If the issue remains unresolved beyond 30 days even after reaching out to the above channels, or if the response is unsatisfactory, you may write to the Banking Ombudsman for an independent review. Details of the Banking Ombudsman Scheme are available on the Reserve Bank of India (RBI) website at https://www.rbi.org.in/

The Bank shall ensure that all cash backs, discounts and other offers advertised by Federal Bank One Co-Branded Card Credit Card, if any, are delivered to the cardholder on time. The cardholder may approach the bank for any disputes in this regard.

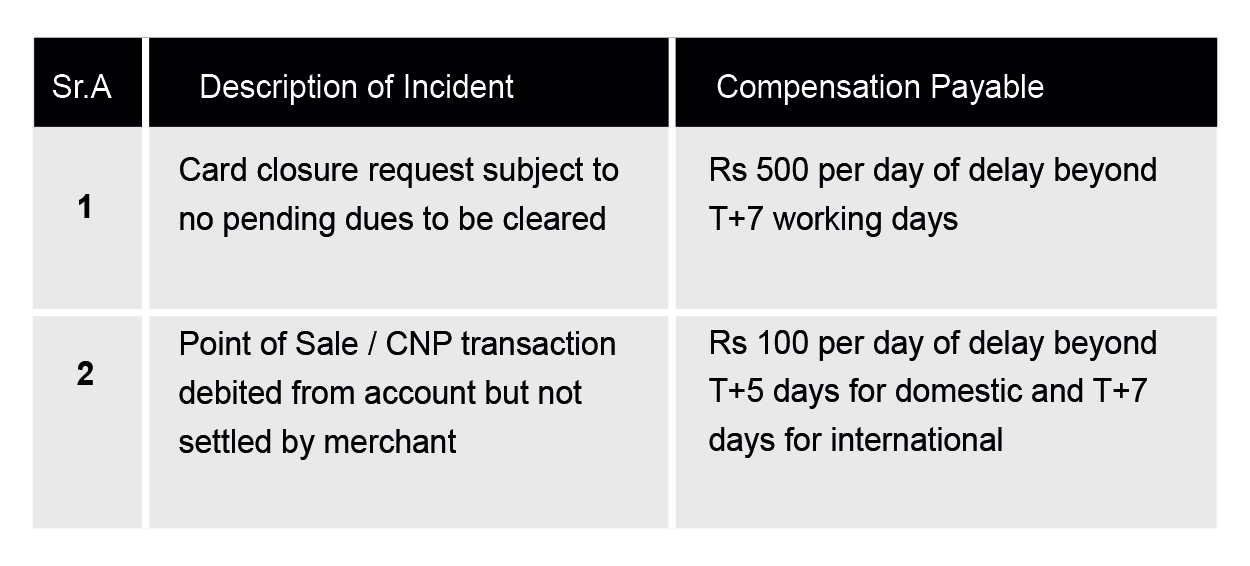

ii) Below compensation framework will be followed in case of delay in resolving

iii) Contact details of the card-issuer are as following

📧 Email your query or concern to help@getonecard.app

📞 Call us on our helpline number at 1800-210-9111

🏢 Write to us or visit us at: FPL Technologies Pvt. Ltd., West Bay, Survey No. 278, Hissa No. 4/3 Pallod Farm, Phase II, Baner, Taluka Haveli Baner Gaon, Pune - 411045, Maharashtra - India

If you are not satisfied with the response from regular channels, you can send an email to grievances@fplabs.tech

I) REWARD POINTS 🎁

By using your Federal Bank One Co-Branded Card Credit Card, you are automatically enrolled in the Federal Bank One Co-Branded Credit Card Rewards Programme. When you transact with your Federal Bank One Co-Branded Card Credit Card, reward points are credited to your Federal Bank One Co-Branded Card Credit Card account depending on the transaction value and the purchase category. These reward points can be accumulated and further used to repay other purchases or redeemed for exciting offers shown in the OneCard App from time to time.

I. Earn Reward Points

a) Reward points will be credited only on regular purchases across any category.

b) Reward points will not accrue for money transfers, rent payments, fuel purchases (effective 15-Dec-2023), cash withdrawals and digital wallet loading or top-up transactions. Sometimes, when you purchase a service/product on a digital wallet app which also offers in-app purchases, you may not get reward points, as it involves actual wallet load, which is then used to make payment to the merchant.

c) Currently, you will get 1 Reward Point on every purchase of ₹ 50.

d) For purchase amounts below ₹ 50, fractional points will be credited. For example, if you spend ₹ 25 on a recharge, 0.5 reward points will be credited.

e) Bonus Rewards: Valid and confirmed purchases across the Top 2 categories in a month are eligible for “5X” rewards, which means you would receive 5 times the reward points on those categories for that month.

- To qualify, you must make purchases across at least 3 categories in a month. From these, the top 2 categories would be eligible for 5X rewards.With effect from January 6th, 2025, you will need to make a minimum spend of Rs. 750 in each of the 3 categories to qualify.

- Points accruing due to 5X rewards will be credited to your points balance on the 10th day of the subsequent month. For example, if your purchases in July are eligible, 5X points will be credited to your points balance on August 10.

II. Redeem Reward Points:

a) No fee is levied if you wish to redeem reward points.

b) Rewards points can be redeemed including in the following ways:

- Pay with points: which lets you pay for previous transactions

- Redeem points for other offers/benefits as applicable from time to time

c) The “Pay With Points” functionality will be available against transactions that are less than two months old. For example, if you make a purchase on July 15, you can repay it with points till September 14 only (subject to available points balance).

d) On redemption, the rewards points so redeemed will be automatically subtracted from the accumulated reward points in your Federal Bank One Co-Branded Card Credit Card account.

e) To pay with points, simply swipe right on a transaction. In case available points are inadequate, a message will be shown to indicate how many points are needed.

III. Other Terms:

a) Reward points which have been credited or debited to or from your Federal Bank One Co-Branded Card Credit Card account shall be reflected on the OneCard app. You can also view the reward points accumulated by you on the OneCard app.

b) FPL as authorized by Bank reserves the right to wholly or partly modify the Federal Bank One Co-Branded Credit Card Rewards Programme. FPL as authorized by Bank also reserves the right to change the reward point conversion rate, withdraw reward points awarded or to vary any of the terms and conditions herein in its absolute discretion without prior notice to the cardholder.

c) In case this Federal Bank One Co-Branded Credit Card Rewards Programme comes in conflict with any rule, regulation or order or any statutory authority, then FPL as authorized by Bank has the absolute authority and right to modify or cancel this rewards programme to give effect to said requirements.

d) Reward points do not expire and have lifetime validity, except in circumstances detailed below:

- If the Federal Bank One Co-Branded Card Credit Card is not used for more than 365 days, the accrued reward points will be nullified.

- FPL as authorized by Bank reserves the right to cancel or suspend the accrued reward points if the Federal Bank One Co-Branded Card Credit Card account is in arrears, suspension or default or if the Federal Bank One Co-Branded Card Credit Card account is or is reasonably suspected to be operated fraudulently.

- In case of cardmember’s death, the reward points earned but not redeemed at that time will be forfeited.

- If a transaction is reversed by way of a refund/chargeback/reimbursement, the transaction amount shall be credited back to your Federal Bank One Co-Branded Card Credit Card account. In such instances, the reward points accrued on those transactions will be reduced from the overall points balance.

- In case a cardmember cancels vouchers that were availed of by redeeming reward points, points can be reinstated at FPL as authorized by Bank’s discretion at the same rate at which they were redeemed.

- On closure/termination of Federal Bank One Co-Branded Credit Card membership, any reward points pending to be claimed in the cardmember’s account will be forfeited.

e) FPL as authorized by Bank will not be held responsible if any supplier of products / services offered to you withdraws, cancels, alters or amends those products / services.

f) FPL as authorized by Bank makes no warranties for the quality of products / services provided by the merchant establishments participating in the Federal Bank One Co-Branded Credit Card Rewards Programme.

g) You may note that every purchase is assigned a different “Category” depending upon the Merchant Category Code (“MCC”) defined by Card Network i.e. Visa,/MasterCard/ Rupay or authorised service providers of the bank. For example, Food & Dining, Shopping, Travel, Entertainment, Groceries, Bills & Utilities, Fuel, and so on.

With effect from January 6th, 2025, the below clauses [I (III) (h) to I (III) (k)] shall be applicable to your Federal Bank One Co-branded Credit Card:

h) Reward points can be earned in categories such as Education, Bills & Utilities, and Insurance, as defined by the Merchant Category Codes (MCCs) from our network partner or categorized by the Bank. For these categories, if eligible for 5X rewards, incremental rewards will only be offered subject to the total rewards under these categories not exceeding 25,000 points.

i) To ensure compliance with applicable law, Terms and Conditions, and the Bank’s policies, the Bank reserves the right to conduct periodic checks on your Credit Card usage. These checks may identify excessive utilization beyond the approved credit limit within a single statement cycle, unusual spending at select merchants, payments towards other Credit Cards or loans, transfers to savings accounts, potential collusion with merchants, or usage for non-personal/business purposes. Additionally, misuse of features, offers, or programs to accumulate undue rewards or cash back may also be investigated. In such cases, the Bank may, at its discretion, cancel the affected Credit Card and any additional cards, and may also withhold or cancel any earned cashback or rewards without prior notice to the Cardmember. The Bank reserves the right to reclassify merchant categories based on their transaction behavior and the specific use cases associated with those merchants. This recategorization may also affect any applicable fees or cumulative threshold levels related to transactions within those categories.

j) In case the used rewards points are to be recovered as part of cancellation or merchant EMI conversion or revocation as mentioned above, the equivalent rupee value of used reward points will be added to the customer’s next statement/ as decided by the Bank and the Cardmember will be required to pay the same.

k) Requests for card closure will be subject to the customer paying the amount equivalent to the negative reward points.

J) REFERRAL PROGRAMME 💳💳

These referral programme terms and conditions shall apply to the customer who uses the Federal Bank One Co-Branded Card Credit Card (“Cardholder”/”You”) and the person who agrees to be referred to the Federal Bank One Co-Branded Credit Card (“Referred User”). Participation in this referral programme is entirely voluntary and it is understood that participation by the Cardholder, shall be deemed to have been made on a voluntary basis. This programme will be applicable for all Federal Bank One Co-Branded Card Credit Cards activated via referral links on and after November 10, 2020.

a) You will receive Two Thousand Five Hundred (2,500) bonus reward points for every new user who joins Federal Bank One Co-Branded Card Credit Card through your referral link.

b) The Referred User will have to download the OneCard app using the link provided by you and activate their virtual Federal Bank One Co-Branded Card Credit Card. You will receive bonus points only for Referred Users who successfully activate the Federal Bank One Co-Branded Card Credit Card.

c) If a Referred User does not join Federal Bank One Co-Branded Card Credit Card through your referral link, then you will lose out on the bonus points.

d) Points earned for referring users will not be eligible for the monthly 5X rewards boost.

e) If a Referred User is already a OneScore App user and has applied for Federal Bank One Co-Branded Card Credit Card, then such a Referred User will not be considered for bonus reward points.

f) If more than one Cardholder provides the same reference, the Referred User shall receive a referral link from both the Cardholders and the Referred User can choose to apply using any referral link and the corresponding Cardholder shall receive the reward points.

g) The referral link shall be valid only for 30 days. In case a Referred User joins after 30 days, then the Cardholder will not receive points for the same.

h) Along with the referral rewards value and applicable limits, the decision of issuing Federal Bank One Co-Branded Card Credit Card to the Referred User will be at the sole discretion of FPL as authorized by Bank Technologies, as per our evaluation policy, and is subject to change without prior notice.

i) IMPORTANT Sharing of personal information between the Cardholder and the Referred User:

As part of this referral programme and the Cardholder being able to receive reward points for successful referrals using a referral link, the Referred User acknowledges, understands and agrees that when the Referred User accepts the invitation via the referral link and successfully activates the virtual Federal Bank One Co-Branded Card Credit Card, the Cardholder will know that the Referred User has received the Federal Bank One Co-Branded Card Credit Card. If the Referred User desires to avoid disclosing this personal information, then the Referred User may choose to apply independently and not via the referral link sent by the Cardholder. Likewise, by sending a referral link, the Cardholder, acknowledges, understands and agrees that the Referred User will know that the Cardholder stands a chance to get rewarded by way of bonus points. If the Cardholder does not desire to disclose this information, the Cardholder should not send a referral link. All communications related to the Federal Bank One Co-Branded Card Credit Card approval or rejection will be communicated to the Referred User only and not to the Cardholder. Only a successful referral will trigger a communication to the Cardholder along with the reward redemption details.

j) FPL as authorized by Bank reserves the right to disqualify the Cardholder from the benefits of this programme, if any fraudulent activity is identified as being carried out for the purpose of availing the benefits under this programme or otherwise by use of the Federal Bank One Co-Branded Card Credit Card.

k) You can earn bonus reward points for a maximum of 25 referrals in any calendar month, and a maximum of 100 referrals in a calendar year.

l) FPL as authorized by Bank has the sole discretion to change, suspend or modify, from time to time, the referral programme and the terms and conditions herein in accordance with applicable laws.

K) Classification as Special Mention Account (SMA) and Non-Performing Asset (NPA)

With reference to the financial assistance/credit facility in the form of Federal One co-branded Credit Card being availed by me on the date hereof issued by Federal Bank Ltd. (“Federal Bank”), I hereby confirm having understood the concepts and illustrative examples (as detailed below) relating to due dates, classification of borrower accounts as Special Mention Account (“SMA”) or Non Performing Asset (“NPA”) in the course of the conduct of the accounts.

Concepts / clarifications / Illustrative examples on due dates and specification of SMA / NPA classification dates.

Dues: Dues mean, the principal / interest / any charges levied on the loan account which are payable within the period stipulated as per the terms of sanction of the credit facility.

Overdue: Overdue mean, the principal / interest / any charges levied on the loan account which are payable but have not been paid 13 within the period stipulated as per the terms of sanction of the credit facility. In other words, any amount due to the Bank under any credit facility is ‘overdue’ if it is not paid on the due date fixed by the Bank.

Lending institution (i.e. Federal Bank) will recognize the incipient stress in loan accounts, immediately on default, by classifying them as SMA. The basis of classification of SMA category shall be as follows:

| LOANS IN THE NATURE OF TERM LOANS/CREDIT CARD | | | — | | — | | SMA Sub-categories | Basis for classification = Principal or interest payment or any other amount wholly or partly overdue | | SMA-0 | Up to 30 days | | SMA-1 | More than 30 days and up to 60 days | | SMA-2 | More than 60 days and up to 90 days |

Non-performing Asset:

I. A credit card account will be treated as non-performing asset if the minimum amount due, as mentioned in the statement, is not paid fully within 90 days from the payment due date mentioned in the statement.

II. Illustrative movement of an account to SMA category to NPA category based on delay /nonpayment of dues and subsequent upgradation to standard category at day end process:

| Due date of payment |

Payment Date | Payment Covers | Age of oldest dues in days |

SMA / NPA Categorization |

SMA since Date / SMA class date |

NPA Categorization |

NPA Date |

|---|---|---|---|---|---|---|---|

| 01.01.2022 | 01.01.2022 | Entire dues upto 01.01.2022 | 0 | NIL | NA | NA | NA |

| 01.02.2022 | 01.02.2022 | Partly paid dues of 01.02.2022 | 1 | SMA 0 | 01.02.2022 | NA | NA |

| 01.02.2022 | 02.02.2022 | Partly paid dues of 01.02.2022 | 2 | SMA 0 | 01.02.2022 | NA | NA |

| 01.03.2022 | Dues of 01.02.2022 not fully paid 01.03.2022 is also due at EOD 01.03.2022 |

29 | SMA 0 | 01.02.2022 | NA | NA | |

| Dues of 01.02.2022 fully paid. Due for 01.03.2022 not paid at EOD 01.03.2022 |

1 | SMA 0 | 01.03.2022 | NA | NA | ||

| No payment of full dues of 01.02.2022 and 01.03.2022 at EOD 03.03.2022 | 31 | SMA 1 | 01.02.2022/03.03.2022 | NA | NA | ||

| Dues of 01.02.2022 fully paid. Duefor 01.03.2022 not fully paid at EOD 01.03.2022 | 1 | SMA 0 | 01.03.2022 | NA | NA | ||

| 01.04.2022 | No payment of dues of 01.02.2022, 01.03.2022 and amount due on 01.4.2022 at EOD 01.04.2022 |

60 | SMA 1 | 01.02.2022 / 03.03.2022 | NA | NA | |

| No payment of dues of 01.02.2022 till 01.04.2022 at EOD 02.04.2022 | 61 | SMA 2 | 01.02.2022 / 02.04.2022 | NA | NA | ||

| 01.05.2022 | No payment of dues of 01.02.2022 till 01.05.2022 at EOD 01.05.2022 |

90 | SMA 2 | 01.02.2022 / 02.04.2022 |

NA | NA | |

| No payment of dues of 01.02.2022 till 01.05.22 at EOD 02.05.2022 |

91 | NPA | NA | NPA | 2.05.2022 | ||

| 01.06.2022 | 01.06.2022 | Fully Paid dues of 01.02.2022 at EOD 01.06.2022 |

93 | NPA | NA | NPA | 2.05.2022 |

| 01.07.2022 | 01.07.2022 | Paid entire dues 01.03.2022 & 01.04.2022 atEOD 01.07.2022 | 62 | NPA | NA | NPA | 2.05.2022 |

| 01.08.2022 | 01.08.2022 | Paid entire dues of 01.05.2022 & 01.06.2022 at EOD 01.08.2022 |

32 | NPA | NA | NPA | 2.05.2022 |

| 01.09.2022 | 01.09.2022 | Paid entire dues of 01.07.2022 & 01.08.2022 at EOD 01.09.2022 but not paid the dues of 01.09.2022 |

1 | NPA | NA | NPA | 2.05.2022 |

| 01.10.2022 | 01.10.2022 | Paid entire dues of 01.09.2022 & 01.10.2022 |

0 | Standard account with no overdues |

NA | NA | STD from 01.10.2022 |

l/we also understand that the aforesaid few examples are illustrative and not exhaustive in nature covering common scenarios, and that, the IRACP norms and clarifications provided by RBI on the subjects referred above will prevail.

IMPORTANT REGULATORY INFORMATION

i) Your Federal Bank One Co-Branded Card Credit Card is valid for use both in India as well as abroad. It is, however, not valid for making foreign currency transactions in Nepal and Bhutan.

ii) Foreign exchange trading through Internet trading portals is not permitted. In the event of any violations or failure to comply, you may be liable for penal action and/or closure of the card.