Credit Card Transaction Failed: Money Debited? Here's What To Do

By OneCard | September 15, 2023

Rahul recently purchased his favourite shoes at a mall. The executive at the cash counter swiped Rahul’s OneCard, but for some reason the transaction was not successful, and the charge slip did not emerge from the card machine. But Rahul got a notification about the debit from his card. Not sure of what happened, Rahul tried to talk with the sales executive, but to no avail. He wondered what to do next—whether he should swipe it again, use some other card, or simply not buy the shoes and wait for clarity from the card issuer.

Do you find this situation relatable? If yes, this blog is intended to answer all your queries about transactions that don’t go through in the first go.

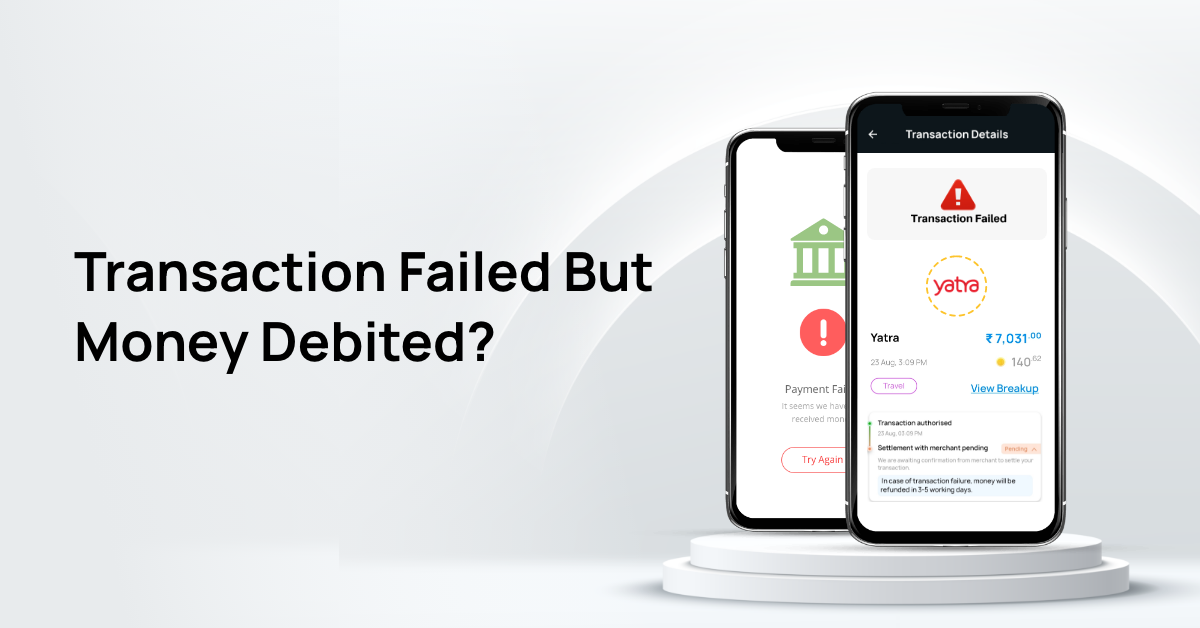

What happens when money is debited but doesn’t reach the merchant/seller

When you use your credit card at an online or offline store and money is deducted from your account but doesn’t reach the merchant, it is called a failed transaction.

How is it different from a declined transaction?

A transaction can be declined or rejected for multiple reasons. Some common reasons are entering incorrect card details, exceeding the credit limit, having a credit card blocked, etc. However, when a transaction fails, it happens because something went wrong while the transaction was taking place between the merchant, the payment gateway, and the issuing bank.

Sometimes a transaction’s status is changed right away to “failed,” while other times it may show as “pending” before being changed to “failed” or “settled.”

What happens when a transaction fails?

When you use your OneCard to attempt a transaction, we receive the data and wait for the settlement to take place.

- The transaction may take up to 5 days for settlement.

- If the transaction is not settled within 5 days, we reverse the transaction and refund the amount to you.

- If the transaction gets settled but you were denied the product or service, then you can contact us and claim a chargeback against the transaction.

Does a failed transaction appear on the bill?

If a transaction remains pending or fails, it will not appear on your upcoming bill. Also, if your transaction is of a large amount and it remains pending, we recommend that you wait for some time before you attempt the transaction again. This is because, in the case of a pending transaction, your credit limit equal to the transaction amount is temporarily blocked till your transaction is settled.

Also Read: One Credit Card Rent Payment Through OneCard App

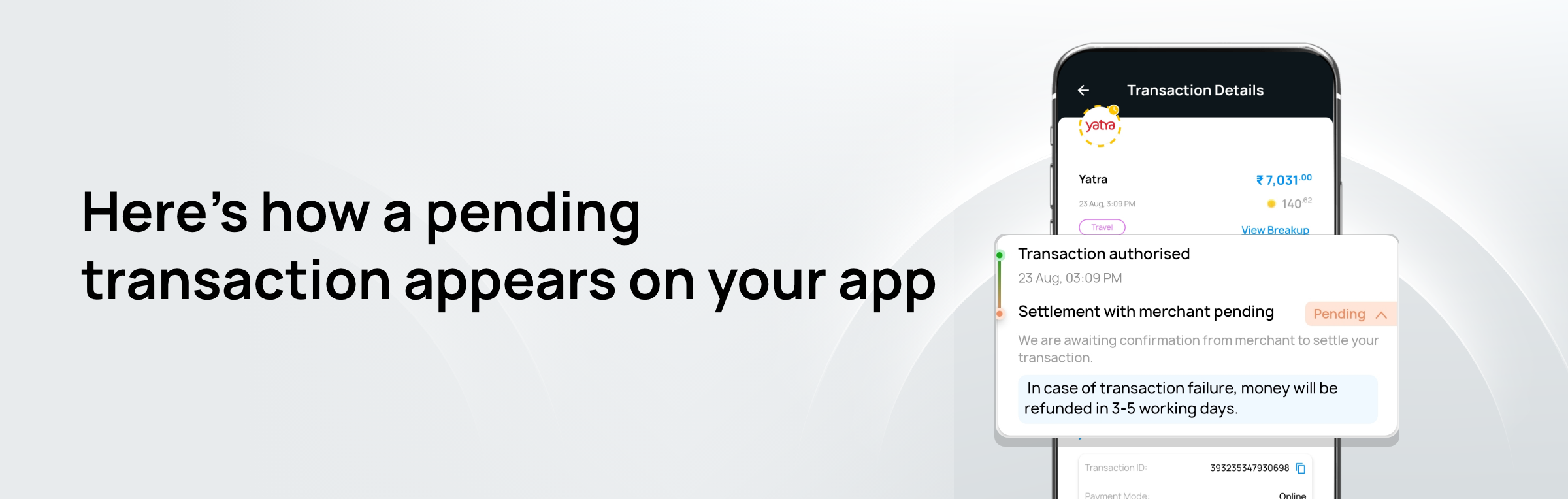

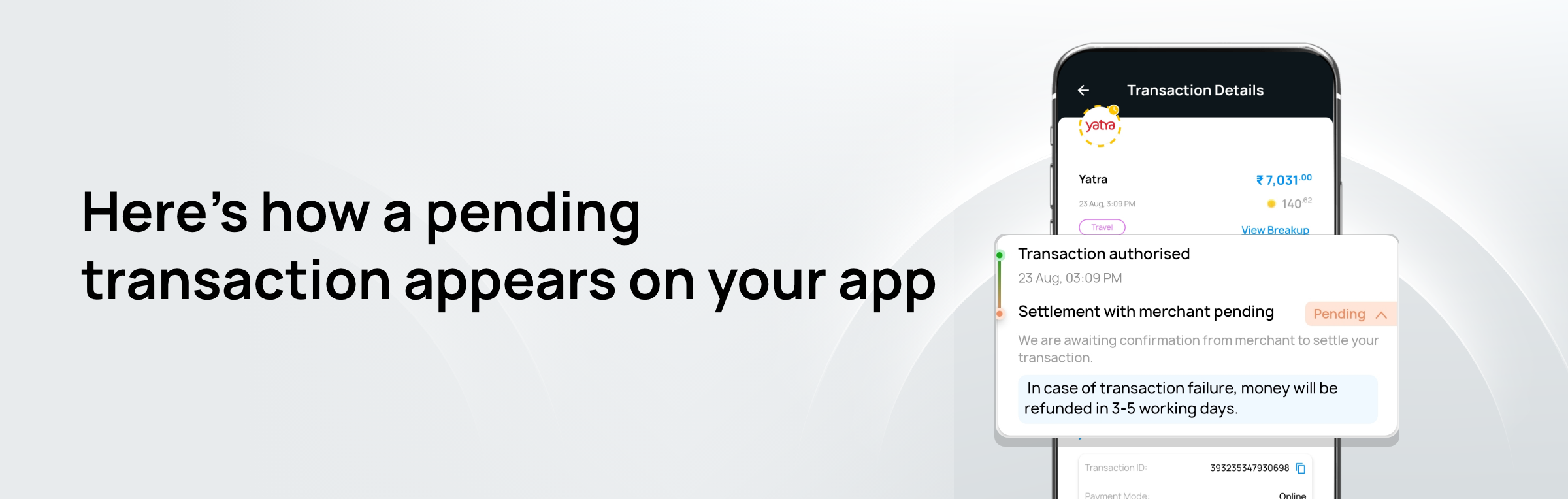

Check the status of your transaction

This is how a pending transaction will appear in your transaction history

Why do transactions fail?

Transactions failing with money getting debited may happen for a variety of reasons, including:

1. Technical errors

A temporary technical glitch in the payment gateway or processing system can lead to failure of your transaction while the money is debited.

2. Authorization Holds

When you make a transaction, the issuer often places a temporary hold on the amount in your account. If the transaction fails, this hold might persist for a few days before the funds are released back to you.

3. Network Issues

If the card machine is not in a proper network area or the network is interrupted, it may lead to improper communication between the merchant, the payment gateway, and your issuer, leading to a failed transaction with money debited from your account.

How to claim a chargeback

In most cases, your money will be automatically refunded to you within 10 days. But in case it doesn’t happen, you can claim a chargeback by:

- Chatting with us by visiting the Help section in your app

- Sending an email to help@getonecard.app

FAQs

1. If my transaction is pending, should I attempt it again?

Feel free to reattempt the transaction if it has failed to reach the merchant. In most cases, if the transaction has failed with the merchant, the money will be reversed to you automatically within 5-7 days and won’t be billed to you. In case it gets settled and you were denied services, you can claim a chargeback with our customer support team.

However, in cases of transactions of large amounts, rent payments, or transactions with risky merchants, we recommend you wait to check the status of the transaction, as these transactions may take time to settle and your credit limit will be blocked till it settles.

E.g., if you transacted for Rs. 50,000 and your overall limit is Rs. 80,000, your available limit will become Rs. 30,000 until the transaction is settled.

2. Money was debited from my account twice, but I got the service only once. What should I do?

If you re-attempt the transaction, the money will be debited twice from your account. If both transactions settle, you can ask the merchant to refund you the extra amount. Alternatively, you can contact us to get a chargeback for the first transaction.

3. Does a failed transaction impact the offer (promocode) validity?

Whether an offer promocode can be used again in the event of a failed transaction completely depends on the merchant’s terms and conditions. The merchant sets a time after which the promocode can be used again. Please check the offer details for the exact terms and conditions.

Also Read: Impact Of Missing Credit Card Payment

**Disclaimer: The information provided in this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Technologies Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader for making any decision based on the contents and information. Please consult your advisor before making any decision.

Sharing is caring 😉