Tips for Managing Money While Travelling Abroad

By OneCard | November 15, 2023

Making preparations for an international trip can be exciting, yet it can also be somewhat stressful, especially when it comes to planning your finances. Whether it is deciding on your payment modes or choosing the currency to pay in, this blog will help you with it all.

1. Shortlist your modes of payment

Decide on a couple of modes of payment that you would like to use while travelling abroad. Avoid restricting yourself to just one mode, like cash. While cash is a reliable mode, you should get yourself a credit card, or a forex card, to carry out the majority of your transactions. Cards offer better security, and you can also avail of other benefits such as reward points or travel offers. You can also save on the forex fees if you use a credit card like OneCard, which offers a 1% forex fee.

2. Make a realistic budget

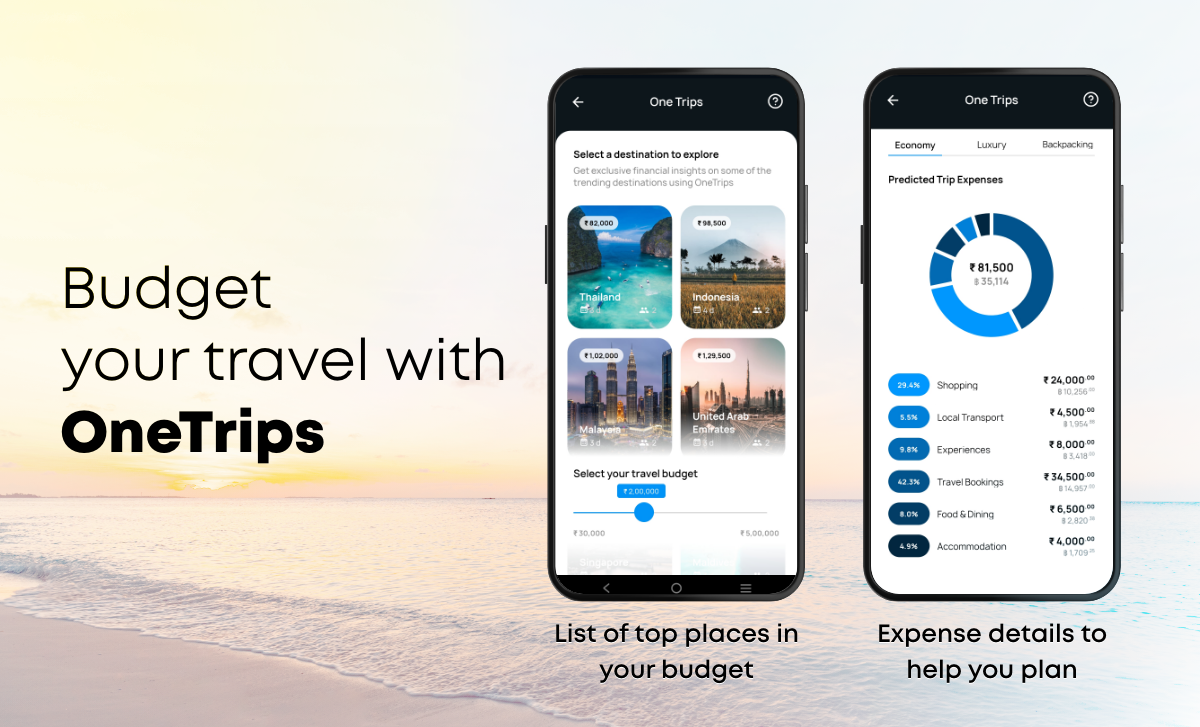

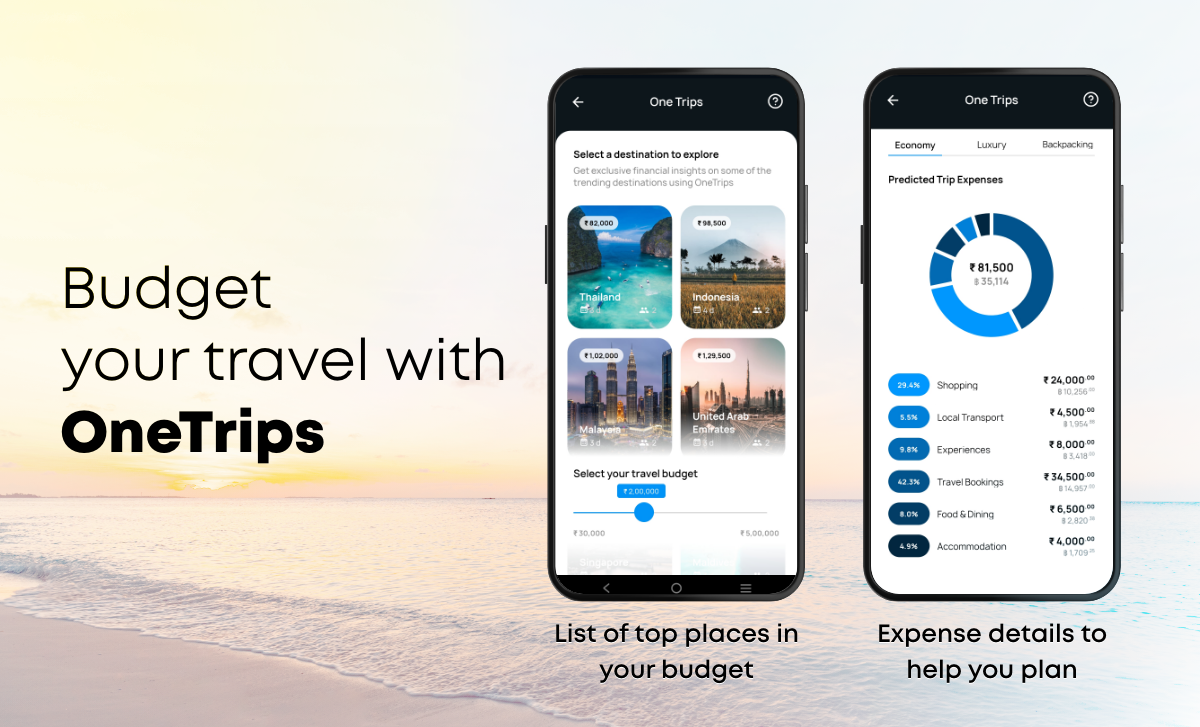

While you may wish to plan a super-economy trip, you need to take into consideration various practical aspects of your trip. For example, you may plan to save on food costs; however, in reality, there might not be many cheap food options in your destination country. So it is important to research and make a realistic budget so you can plan your finances better. If you are a OneCard user, you can explore OneTrips to get a preliminary idea of the budgets required for popular travel destinations abroad.

3. Use the local currency when using your card

When using your card to shop locally, the merchant will ask you to choose the currency for the payment. Always choose the local currency of the merchant to avoid extra charges on your transactions. For example, if you are in Japan, you should pay in yen with your card instead of opting for some other currency. Doing so will help you avoid double charging of forex fees.

4. Check your transaction settings

If you plan to use your regular credit card, make sure you have turned on the international transaction settings. If required, you should also inform the card issuer or the bank about your travel to avoid any transaction declines while paying abroad. Also, when you are abroad, you may not be able to call customer service easily, so it’s a good idea to learn about alternative ways of contacting them in case you need to.

5. Prepare an emergency fund

Securely store a decent amount of local currency, in cash, somewhere in your luggage. The reason is that not all places may accept cards, and there can also be some unforeseen situations that may require you to resort to your emergency funds.

6. Research about travel insurance

Buying travel insurance is mandatory for many destinations. Make sure you research it thoroughly by checking the inclusions, deductibles, and claim process, along with looking for the cheapest option available out there.

7. Optimise your ATM usage

If you plan your finances well, you might never need to use an ATM to withdraw cash. However, if you must, check for the withdrawal fees before withdrawing any cash. Additionally, withdraw larger amounts to avoid using the ATMs frequently.

8. Look up local customs

For example, bargaining prices at local shops may be common in many countries, but not all cultures might welcome it. Or in some countries, tipping is seen as good, while other countries might not accept it well. You will also need to know what the appropriate amount is for tipping to avoid undertipping or overtipping in some cases.

We hope the tips we shared above will help you plan the finances for your trip and make it more enjoyable. And if you are a OneCard user, don’t forget to check out the newly launched OneTrips feature in the app to get help with your travel plans and explore travel related offers.

ALSO READ: Best Travel Credit Card in India

**Disclaimer: The information provided in this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Technologies Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader for making any decision based on the contents and information. Please consult your advisor before making any decision.

Sharing is caring 😉