Should You Increase Your Credit Card Limit

By OneCard | July 07, 2023

Credit limit increases are usually initiated by credit card issuers after you become a regular patron of their cards. You may receive a phone call, app notification, or an email that allows you to opt in for an increase in your credit limit. You may wonder whether or not you should opt for this increase and whether there are any disadvantages to doing so.

This blog will uncover the truth behind the most common myths about credit limit increase and help you make an informed decision on whether you should opt in for a credit limit increase.

Common Myths About Credit Limit Increase

Myth 1: A credit limit increase may reduce my credit score

In reality, a credit limit increase can potentially improve your credit score. This is because, with a higher limit, you can spend the same per month without increasing your credit utilisation ratio. Moreover, a higher credit limit improves your creditworthiness for potential lenders.

Myth 2: I will have to pay additional fees for accepting a credit limit increase

Credit card issuers typically do not charge any fees for increasing your credit limit. They offer credit limit increases to users who have a good credit history and who have made timely repayments. However, make sure you watch out for any hidden fees that might not be visible upfront. For example, some credit card issuers may require you to upgrade your card for a higher credit limit, which may require you to pay a higher annual fee. OneCard doesn’t charge any fees for opting in to a credit limit increase offer.

Myth 3: A credit limit increase will make me overspend

An increased credit limit cannot automatically make you overspend. Even with a lower credit limit, you should not be maxing out your credit card. Irrespective of your credit limit, you should maintain a healthy credit utilisation ratio of 30% to maintain a good credit score.

Factors That Help You Increase Your Credit Limit

Having a good credit score

A good credit score is essential to both getting an unsecured credit card and increasing your credit limit. Making timely repayments and keeping a low credit utilisation ratio can help you improve your credit score over time. If you are new to credit and recently got your first credit card, it will take a minimum of six months of good credit behaviour for it to start reflecting in your credit report.

No Days Past Due (DPD)

Late payments or missed payments can negatively impact your credit score, depending on the number of days of delay past the due date. DPD shows how timely you have been in making repayments or EMI payments in the past 36 months. It is an important indicator a new lender will look at before approving your application for new credit or an increase in your credit limit.

ALSO READ: How to Avoid Credit Card Late Payment Charges?

No write-offs

If, despite multiple attempts, a credit card issuer fails to make their defaulter repay their credit card dues, they declare the debt non-recoverable. This process is known as a credit card debt ‘write-off’. However, just because the company declares it a loss doesn’t eliminate the customer’s liability. The company can still assign the case to recovery agencies to attempt collection. Nevertheless, a write-off has a negative impact on your credit score. Having a clean record without any write-offs is essential for a credit limit increase.

No multiple hard enquiries

When you apply for new credit, whether in the form of a credit card or a loan, it triggers a hard inquiry on your credit report. Multiple hard inquiries in a short period of time can be seen negatively, as it may seem that you are desperately in need of credit. Avoid doing so if you are looking to increase your credit limit.

Not being a credit revolver

A credit revolver is someone who is unable to pay their outstanding credit card balance at the end of the billing cycle and is carrying it forward every month. Being a consistent credit revolver poses a higher risk to credit card issuers, making it less likely for you to get a credit limit increase.

Also Read : Credit Card Billing Cycle: What is It and How Does it Work?

Credit Limit Increase for OneCard Users

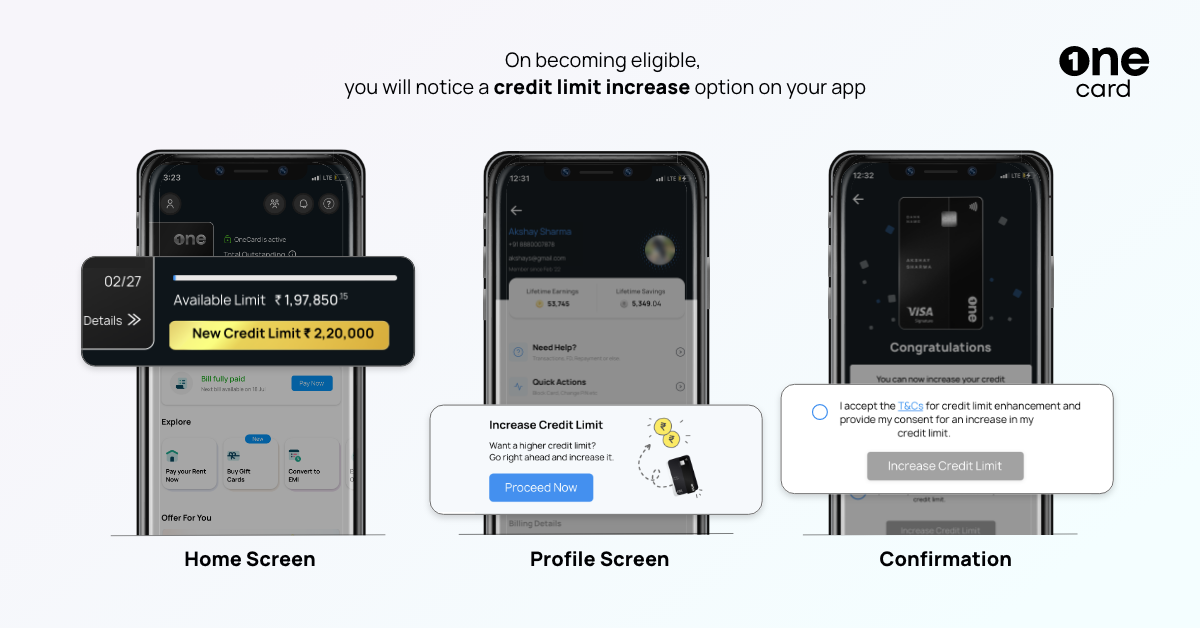

If you are a OneCard user we urge you to keep using your credit card regularly and responsibly to be eligible for a credit limit increase in the future. Once you become eligible, you will be able to find an offer on your OneCard app itself. Typically, we revise offers in a span of three to six months, so keep an eye out for the same.

**Disclaimer: The information provided in this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Technologies Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader for making any decision based on the contents and information. Please consult your advisor before making any decision.

Sharing is caring 😉