How To Manage Your Credit Card Bills Effectively

By OneCard | July 18, 2023

Managing your credit card bills efficiently is vital to making the most of your card. This is because as long as you are utilising the interest free credit period, you are not paying anything extra to use the credit card and are in fact gaining additional benefits in the form of reward points, discounts, an increase in your credit score, affordability, and more. However, if not managed properly, credit card bills can quickly spiral out of control, ultimately landing you in a debt trap.

So, whether you are a seasoned credit card user or just starting out with your first card, this blog will provide you with practical advice that can help you stay on top of your credit card bills.

The Last Thing You Want Is To Fall Behind on Your Credit Card Bills

Here are the top reasons why you must consciously put in the effort to keep your credit card bills in check:

To have peace of mind

By keeping your credit card bills manageable, you can pay them off regularly. This will help bring financial stability into your life and ensure peace of mind for you.

To maintain your credit score

If your credit card bills become unmanageable, you will start paying less than the full balance every month. If in any month you fail to pay even the minimum due, it will start leading to penalties, the accumulation of interest, and even a negative impact on your credit score.

Also Read : CIBIL Score for Credit Card - Minimum CIBIL Score for Credit Card

To avoid the burden of unnecessary fees

Credit cards are best used by people who take advantage of the interest-free credit period of a credit card. The moment you spend more than you can repay each month, you will fall into the trap of late payment fees, high-interest charges, and the headache of trying to recover from the debt.

To detect fraudulent charges, if any

Regularly tracking your credit card bills will allow you to identify any fraudulent activity on your card.

Also Read : How to avoid fraud via screen sharing apps

To ensure you spend within your budget

Although credit cards make big purchases more affordable through EMIs and discount offers, you may get tempted to overspend. Keeping a tab on your credit card bills will help you be conscious of your spending habits and thus stick to a budget.

How To Keep Your Credit Card Bills in Check

Track your expenses

The best credit card apps will instantly post all your transactions on the app. It is a good practice to track your expenses via the app. Alternatively, you can also check the transaction notifications you receive via other mediums, such as app notifications, email, or SMS.

Review the credit card statements

If you are regularly tracking your expenses, there is no need to review the statements separately. However, it is a good idea to review the same if you have set up any EMIs or want to check for any extra charges, such as GST or credit card late payment fees . In the event of any discrepancies, immediately notify your credit card issuer.

Also Read : One Credit Card Statement: A Complete Guide

Set up automatic payments

All credit cards allow you to set up automatic payments or standing instructions to make credit card payments from your savings account.

Set up bill payment reminders

If you have not set up automatic payments, there is a high chance you may forget your credit card due date.

Repay in full each month

While this may not always be possible, try to spend only what you can repay in full each month. The alternative is to look out for EMI offers, either no-cost or standard, depending on how essential it is for you to purchase something.

Customise your credit billing cycle

Each credit card comes with a billing cycle that is decided by the credit card issuer. A lof of times, the due date caused inconvenience to customers if it did not align with their monthly cash inflow and outflow. To provide flexibility in this regard, RBI mandated issuers to give cardholders a one-time option to modify the billing cycle of the credit card as per their convenience.

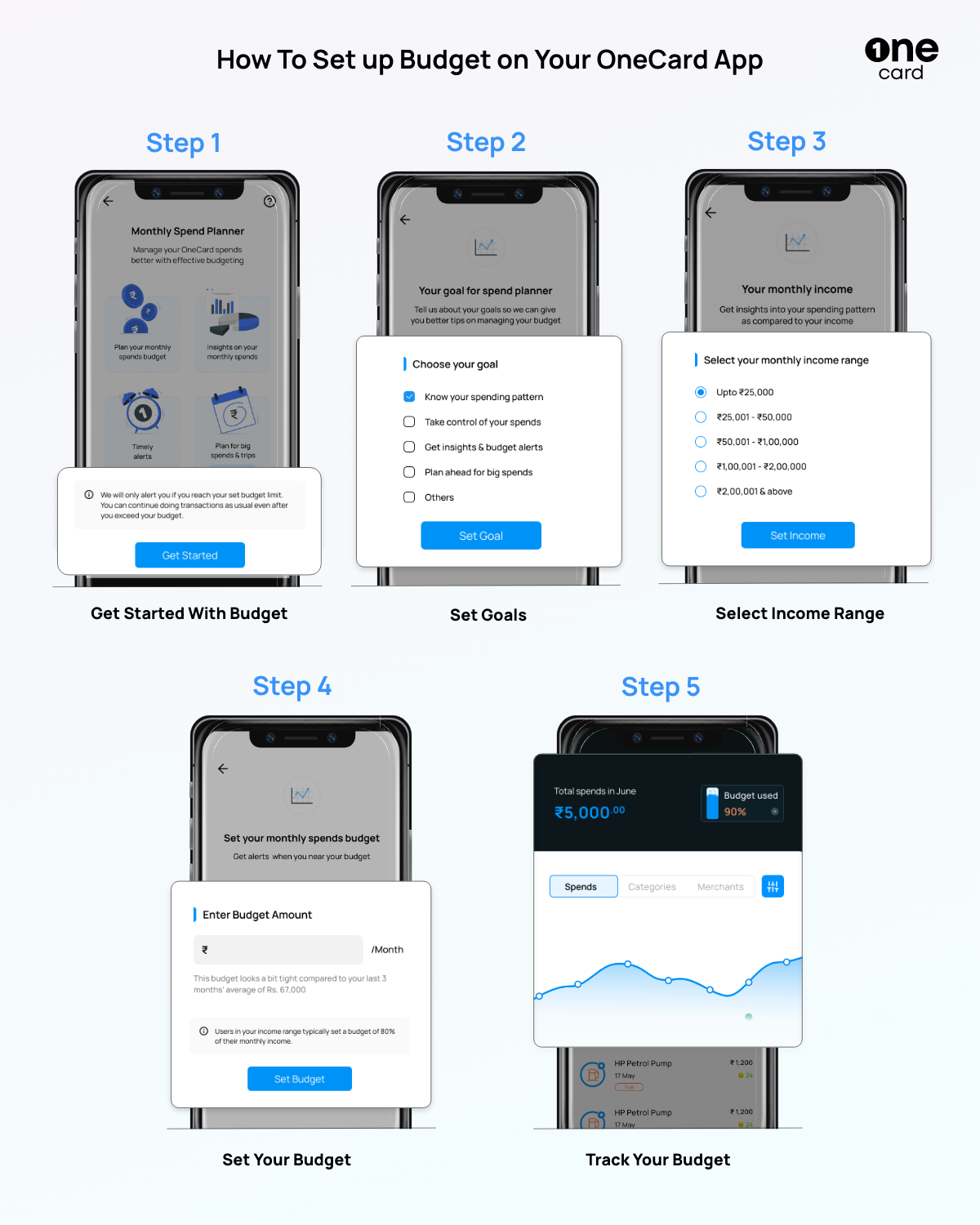

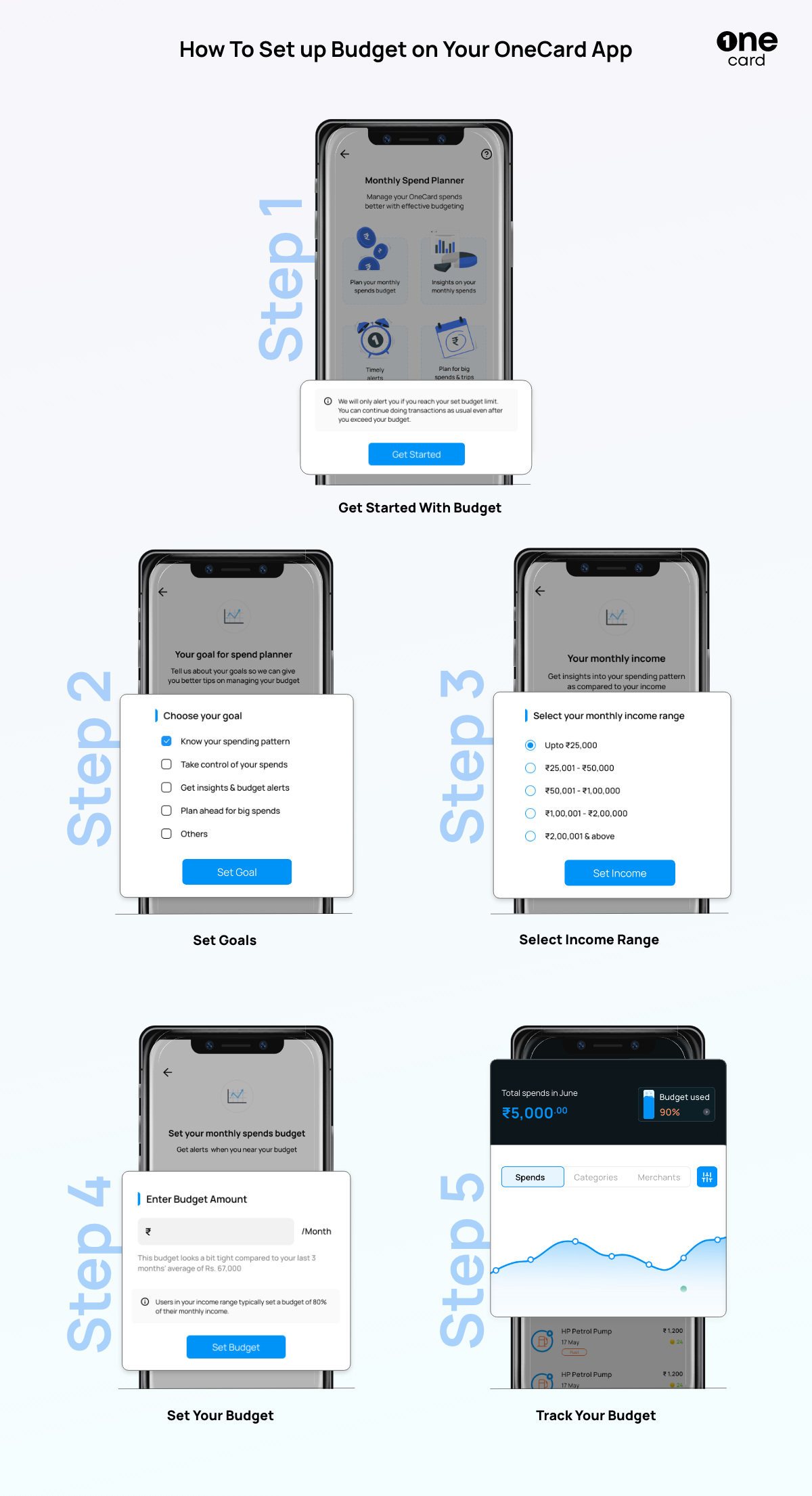

OneCard Spends Planner Helps You Manage Your Credit Card Expenses

At OneCard, we have gone a step ahead and made planning your credit card expenses easier. With our latest feature, called the OneCard Spends Planner, you can easily :

✅ Plan your monthly credit budget to keep your spending in control

✅ Get detailed insights on your spending to check your top spending categories

✅ Get timely alerts on budget status and edit budgets

✅ Plan for upcoming big spends

…all using the OneCard mobile app.

**Disclaimer: The information provided in this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Technologies Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader for making any decision based on the contents and information. Please consult your advisor before making any decision.

Sharing is caring 😉