How to Convert Your Large Credit Card Expenses into EMIs? Easy Steps?

By OneCard | June 24, 2024

Whether it’s an impulsive shopping spree or an unavoidable expense, your credit card is always there for you, even if your bank balance isn’t. However, dealing with massive credit card expenses can lead to daunting bills. This is where EMIs (Equated Monthly Instalments) come in to save the day. Let’s explore how we can convert your credit card expenses into EMIs.

Table of contents:

Understanding EMI Conversion

EMI stands for Equated Monthly Instalment. They are an easier way to repay a credit card loan or a large credit card expenses by spreading out dues over a specific time period. EMIs break down the total amount owed, which consists of both the principal amount and the interest, into smaller, more manageable monthly payments.

Example of EMI Conversion

Imagine you’ve racked up credit card expenses worth ₹1,000. If you decide to convert this into EMIs with a repayment period of 12 months at an annual interest rate of 12%, your monthly EMI would be calculated as follows:

Principal (P): ₹1,000 Annual Interest Rate (R): 12% Monthly Interest (r): R/12 = 1% = 0.01 Loan tenure (T): 12 months

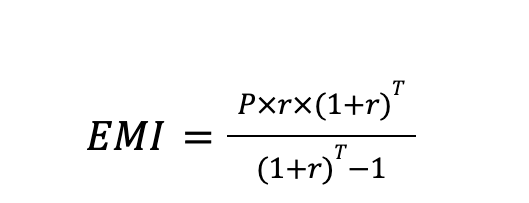

The formula for calculating EMI is as follows:

Using this formula, we can calculate your monthly EMI to be ₹89, with a total payment of ₹1,066 being made over 12 months.

You can see how paying back this significantly smaller monthly payment can be far more manageable than repaying the entire amount at once.

ALSO READ: What Credit Card EMI & How Does It Work?

Benefits of Converting Credit Card Expenses to EMIs

While we have already discussed some of the benefits of converting credit card bills to EMIs, let’s take a deeper look into the advantages:

1. Better Cash Flow Management

By spreading out your payments over several months, it becomes easier to manage your budget. So, you can avoid stressing about large payments and prioritise your credit card expenses.

2. Lower Interest Rates

Oftentimes, the interest charged on EMIs can prove to be quite economical. This is particularly true when the alternative is the payment of high-interest rates charged on a revolving credit card balance. This can help you save a lot of money over time.

3. No Late Payment Penalties

Credit cards can charge significant fines for non-payment of dues. By converting expenses into EMIs, you may find it easier to clear your dues in small, affordable sums and also avoid late payment fees. This can also help protect your credit score.

4. Big Purchases Become Affordable

EMIs can make it feasible for you to afford expensive items even if you don’t have the money to actually buy the item outright. As a result, you can have access to the goods or services you desire without having to wait for long periods.

5. Flexible Repayment Plans

Credit card companies are often quite flexible with their EMI plans. For instance, they often allow you to choose the tenure over which you will repay your credit card expenses. This often ranges from 3 to 24 months.

ALSO READ: Understand One Credit Card Bill Repayment

Converting Your Credit Card Expenses into EMIs Step By Step

Let’s get into the actual process of EMI conversion. Here’s how you can go about converting your credit card expenses into an EMI:

- Verify Eligibility: Check with your credit card provider to ensure you meet the criteria for EMI conversion.

- Check for No Cost EMI: Seek out options for “No Cost EMI,” which waive interest charges, but there could be small processing fees.

- Select the Purchases: Select the specific expense you want to convert into EMIs.

- Select Repayment Tenure: Depending on your card company’s offerings, select a repayment period that suits you.

- Make Payments on Time: Ensure you make your payments on time every month to avoid getting charged late fees.

It is clear that managing your large expenses can be made much easier by converting credit card expenses to EMIs, especially ones like the One Credit Card EMI. With interest rates as low as 1.33% and flexible tenures between 3 and 24 months, you can shop without worrying and pay at your own pace. Check it out to take control of your credit card payments, track your big expenses, and make timely repayments!

**Disclaimer: The information provided in this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Technologies Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader for making any decision based on the contents and information. Please consult your advisor before making any decision.

Sharing is caring 😉